By Michael Collins, Managing Director, EquiNova

January 2023

You could say the past two years in construction supply have mainly been about demand overwhelming supply. How much something cost mattered less than whether it was available. In 2023, we expect price–in a variety of forms–to return to its usual prominent place in business dealings.

Let’s start with shortage-related pricing. You have watched lumber prices fall to the point where any lack of lumber is occurring because mills are being mothballed, not because of high demand. Backups at the ports have eased markedly, though they haven’t gone away. As a result, supply-chain issues are merely causing headaches rather than inducing migraines.

Some consumer prices also have improved dramatically. Retail gasoline that averaged $5.03 per gallon in June had fallen to $3.32 by December. Rents appear to be dropping, and while new-home prices aren’t slipping much in most places, they’re being propped up in good part by concessions from builders that they hadn’t felt the need to offer since 2020. The pressure is on.

Meanwhile, consumers’ inflation expectations over the coming 12 months have fallen from 6.8% in June to 5.0% in December. That’s important, because once an inflationary mentality becomes part of the public mindset, it triggers all sorts of consumer behaviors that often cause even more inflation and becomes even more difficult to stamp out.

Then there’s the Federal Reserve’s view of inflation, both on the consumer level and through lending rates. Wall Street keeps hoping the Fed will relent, but policymakers appear resolute in assuring that the inflation beast is well and truly dead before they pull back on rates. That means mortgage rates won’t fall back below 3% anytime soon.

These factors combine to produce a weakened economy–particularly a housing economy–in which customers are much more likely to focus on price when they consider buying a new home or renovating their current one. It will be harder for dealers and builders to make money this year than it has been for them to do so in the past two. In the M&A world, this trend is likely to lead both buyers and sellers to view a company’s numbers differently–perhaps more conservatively when the buyer is envisioning that operation’s future.

On the other hand, buyers want to see how well a dealer responds as conditions get tough. This is an opportunity for quality operations to significantly distance themselves from competitors. Top-flight companies will look better than ever. We can help you reach that tier.

LBM’s M&A Market Features Robust End-of-’22 Activity and Plenty of Plans for 2023

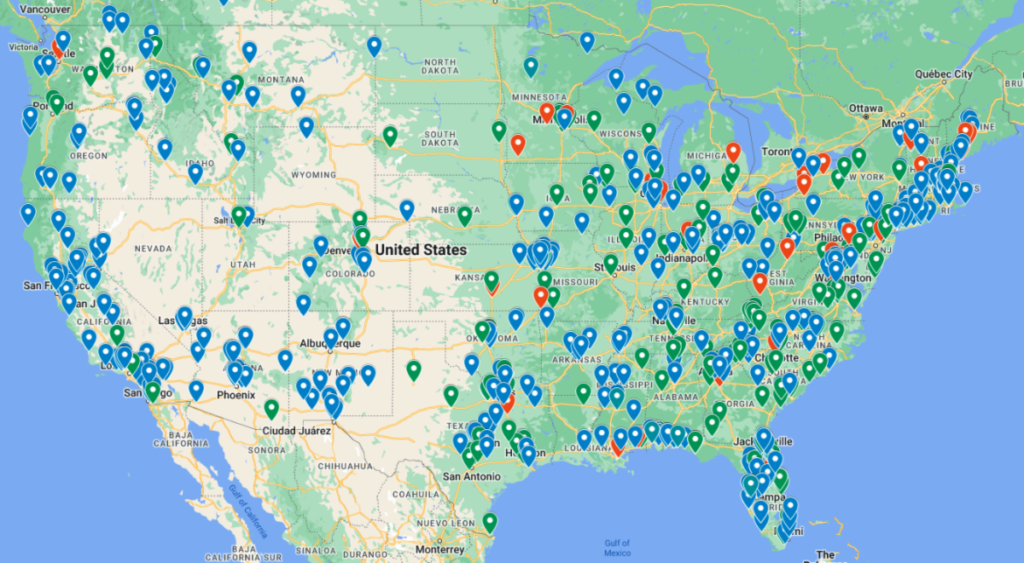

By Craig Webb, President, Webb Analytics

As final numbers for 2022 trickle in–and new reports for 2023 arrive–the M&A scene in construction supply continues to be robust. Webb Analytics’ deals database shows 421 facilities changed hands last year, while there also were 204 greenfield openings. That’s almost half the number of acquisitions compared with 2021, but 19% more openings.

There were 147 transactions in 2022 vs. 176 the year before, Webb Analytics finds. The number of buyers also dropped, to 67 in 2022 from 102 in 2021.

So far this year, there have been four deals announced by four buyers that brought them a total of five facilities. In addition, various companies have revealed plans to open 27 new locations.

Closures always take longer to report. For 2022, Webb Analytics has learned of 52 facility closures, while the new number for 2021 is 75. And there is news of three facilities to be closed in 2023.

Among the moves since Dec. 1:

- Beacon Building Products acquired a siding specialist, First Coastal Exteriors of Mobile, AL, and Pearl, MS, as well as a waterproofing company, Whitney Building Products of Boston. Beacon also opened new stores in Augusta, GA; Durham, NC; Brownsville, TX; Georgetown, TX; and La Vergne, TN

- Hilltop Lumber bought Northland Lumber in Park Rapids, MN.

- Ambassador Supply bought a truss manufacturer, Continental Carpentry Components of Wanatah, IN.

- Nation’s Best Holdings went “up north” in Michigan to acquire Forslund Building Supply of Ironwood, Caspian, and Norway, MI.

- Continuing its growth in the Pacific Northwest, Kodiak Building Partners took in Diamond Home Improvement of Grants Pass and Klamath Falls, OR.

- Milwaukee’s Bliffert Lumber stayed in the city by buying a millwork manufacturer, A. Fillinger Inc.

- Contract Lumber expanded to Waller, TX.

- Ogden & Adams bought Delhi (IA) Lumber.

For news on actions involving specialty dealers and hardware stores, click here.

Restrictive Covenants Need to Limit their Scope in Order to Be Effective, Kodiak Case Suggest

A 2022 decision involving Kodiak Building Partners and an ex-employee from a company that Kodiak acquired serves as a reminder that courts are viewing non-compete covenants ever more critically, several law firms say. The news also is pertinent because the Federal Trade Commission on Jan. 5 issued a proposed rule that would ban non-compete agreements.

Kodiak Building Partners LLC. v. Adams dealt with a restrictive covenant agreement (RCA) with Phillip Adams, a general manager and part owner of Northwest Building Components. When Kodiak purchased Northwest in June 2020, Adams signed an RCA that included provisions barring him for 30 months from competing with Kodiak and soliciting customers.

Adams remained at Northwest until October 2021, and then about two months later went to work for Builders FirstSource, the Reed Smith law firm reported. By March 22, Kodiak determined it was losing business to BFS. Kodiak then sued Adams, and the case went to Chancery Court in Delaware, where Kodiak is incorporated.

“The court confirmed that a purchaser has a legitimate interest in protecting goodwill purchased from a business’ seller,” the Davis + Gilbert law firm reported in its commentary. “The covenants in Adams’ RCA, however, purported to restrict him from competing with all of Kodiak’s other businesses, and from soliciting all of those businesses’ customers, not just Northwest’s or even those of Kodiak’s other lumber and building materials companies. As the court explained, ‘Kodiak’s legitimate economic interest supporting a restrictive covenant binding a Northwest employee and stockholder does not extend to goodwill and competitive space acquired in other transactions with other Company Group members in other industry segments.’ The court would not enforce covenants seeking to restrict Adams in that other competitive space.”

In its commentary, the Debevoise & Plimpton law firm said in effect that Kodiak lost because its restrictive covenants were too tight. “The dynamic faced by Kodiak Partners—the buyer in this case—is a common one,” it wrote. “… Even where the buyer acknowledges some uncertainty regarding its ability to enforce restrictions that go beyond the scope of the business being acquired, it often considers the risk well worth taking.”

“Ironically, it appears that the selling stockholder’s conduct would have breached even a narrow restriction, limited to the pre-closing business of the target, and that the broader covenant was in this instance unnecessary,” Debevoise & Plimpton wrote. “Nonetheless, for want of a narrower scope, the entire covenant was lost.”

Davis + Gilbert said the Kodiak case “suggests that, at least under Delaware law, courts will limit the enforceability of covenants even in the sale of business context, enforcing them only to the extent to protect specific, legitimate business interests of the buyer.”

This Award-Winning Small Dealer in Kansas Seeks Micro-Investments to Help it Grow

Visit the home page of Microventures and you’ll see solicitations to invest in sports apparel, solar panel kits, medical devices, and digital banking. And then there’s one for The Building Center, a two-store, $2 million lumberyard in the heart of Kansas that is offering convertible notes in the company for as little as $100.

Since the solicitation began in November, 26 investors have put $21,950 into The Building Center, which John Wheeler (pictured above, second from left), started the company in December 2017. He began in Marion, KS (pop. 1,922) and in 2021 expanded within Marion County to the biggest town, Hillsboro (pop. 2,732). Through November, sales were up 57% over the first 11 months of 2021. The Kansas Small Business Development Center at Emporia State University named The Building Center its 2022 Existing Business of the Year.

“We are excited to try this business to raise capital,” the company wrote in November. “The Building Center is committed to operating stores in small towns across the USA. The U.S. Census reports show that there are approximately 7,000 small towns in the U.S. with a population of 1,000 to 5,000. The company foresees a huge opportunity to grow in rural areas, as they see the value and benefit of doing business in these small communities.”

While the amount raised so far by the Building Center is minuscule, this approach is an excellent example of the use of new technology by small companies to gain access to the capital markets.