April 2024

There’s much more that needs to become public before outsiders can truly judge the wisdom of The Home Depot’s decision to spend $18.25 billion for SRS Distribution–a price described as equal to 16.1 times SRS’ 2023 EBITDA. Here are three things that we do know or that have prompted speculation by analysts.

First, this deal isn’t being touted as a synergy-rich uniting of two similar companies. Instead, The Home Depot bills this as an opportunity to add $50 billion to its total addressable market by taking on a company whose revenues nearly top $10 billion. Notably, The Home Depot plans for SRS to remain a separate operation.

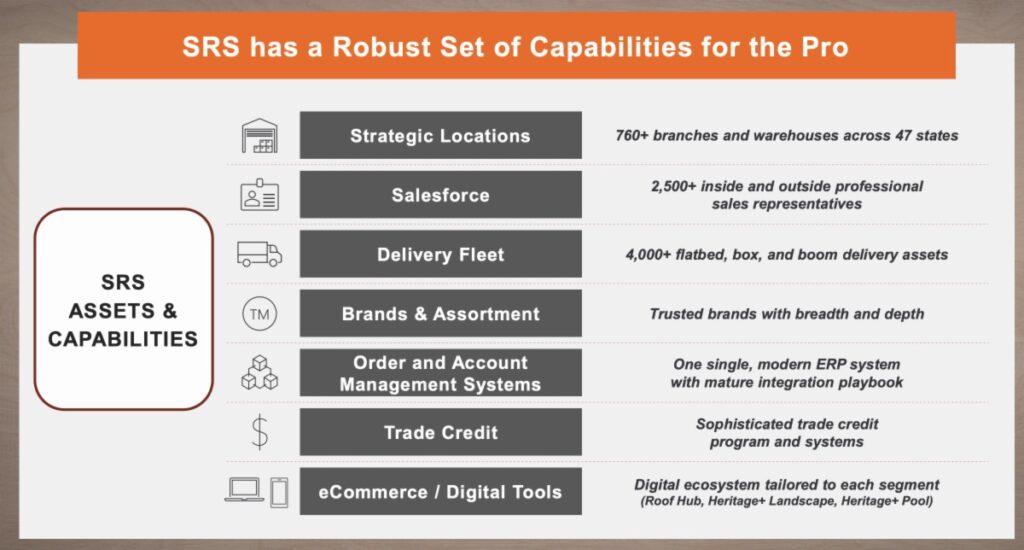

Second, buying SRS will help The Home Depot learn how to sell on account–a vital skill if it hopes to serve what it calls “the complex pro.” At its heart, The Home Depot still is a cash-and-carry business, even if now accepts credit cards along with dollar bills. Selling products on terms isn’t in its DNA, while at SRS it’s a natural part of business. The Home Depot values that knowledge so much it is even thinking of letting SRS handle the entire company’s trade credit portfolio, not just what SRS sells at its 760 locations.

The third takeaway involves competitors and beneficiaries. One might think the purchase is another attempt to widen the gap between The Home Depot and Lowe’s. But Todd Tomalak of Zonda speculates that buying SRS really is meant to buik up The Home Depot’s product mix so it can compete better against Amazon. Meanwhile, Andrew Carter of Stifel sees this purchase benefiting Beacon. The hefty multiple being paid by The Home Depot can only help Beacon’s sales price should any buyer want to make a run at that company, Stifel says. And the overall price paid represents an endorsement of the idea of selling to pro roofers.