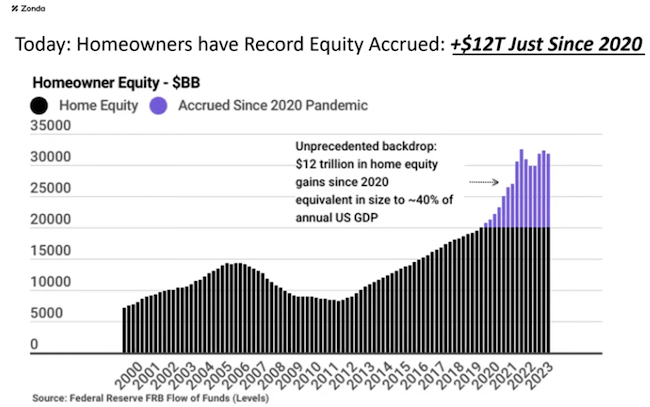

Housing economists often like to include in their presentations a slide showing how much more equity Americans have in their homes these days. The belief is that, once lending rates decline, people will take out home equity loans (HELOCs) and fix up their houses. In a recent webinar, Zonda said that, if homeowners return to traditional patterns of withdrawing cash via HELOCs, we could see spending on siding, kitchens, and window/door projects rise 21% to 31% from 2023 levels.

Boomers hold a big share of that equity, and they are senior citizens now. History tells us that seniors spend more than they earn; according to The Economist, in the mid-1990s people aged between 65 and 74 spent 10% more than they made. But today’s cohort in that same 65-to-74 age group actually saved about 1% of their income, The Economistadds. They also aren’t moving out of their homes when they become empty-nesters.

If these trends continue, it’s possible we’ll see a significant share of this equity remain locked in the home until after Boomers die and pass their wealth on to their children. Such transfers take place years after the Fed makes any rate cuts this fall.