June 2022

Welcome to EquiNova Capital Partners LLC, the new company launched by Walt Kurek and me following our years as Managing Directors of Building Industry Advisors. EquiNova Capital Partners (ECP) expands on our previous company by investing private equity capital in middle-market companies as well as merger and acquisition advisory services. As principals of ECP, we have significant transaction experience among distribution and manufacturing businesses, with a particular focus on the building products segment. ECP seeks to work with entrepreneur-owned businesses that are pursuing a transition of ownership or the placement of growth capital to fund the next stage of expansion. We will continue to provide you with useful information via this newsletter. Walt and I look forward to helping you as you plan your future.

Watch My Webinar Conversation

with Several Key Buyers and Sellers

I had the pleasure on June 14 to lead a conversation that brought together veteran acquirers in the LBM segment with several former LBM company owners who have sold their businesses over the past several years. These webinar panelists shed light on timely aspects of mergers and acquisitions from both sides of the negotiating table. Joining me were Jeff Smith, CFO at Kodiak Building Partners (pictured second from left above); Jim Hooper, SVP of M&A at US LBM (second from right); Jon Vaughan, a regional VP at US LBM whose family business, Brand Vaughan Lumber, was acquired by US LBM last July (far right); plus Jerry Jehn of Builders’ Millwork and Tony Shepley of Shepley Wood Products (not pictured). Those two companies were acquired by Kodiak. Among other topics, our panelists discussed their outlook for the industry segment and the impact of inflation on the financial results of LBM distributors. The former owners who have sold their companies shared insights as to what went into making that important decision. You can view a recording of this webinar here. The event was sponsored by Buildxact.

When Making Plans for the Next 18 Months, You’ll Need to Prepare for Multiple Scenarios

Expect today’s glass-half-full economy to make this year’s mid-year review and planning sessions particularly difficult at construction supply companies nationwide. Every day seems to bring new information that runs counter to what you heard the day before. Wall Street’s gloomy attitude contrasts with a housing and lumber price boom that has produced champagne-popping revenue and profit increases, both last year and in 2022’s first quarter. How should you respond? I recommend you prepare for at least four possibilities. The first scenario is the easiest to write and the most fun: Continued growth at a pace near what you’ve been experiencing lately. Even with mortgage rates rising and the Federal Reserve’s plans to keep hiking interest rates, “This is a market as resistant to higher interest rates as you could possibly imagine,” Christopher Thornberg, founding partner at Beacon Economics in Los Angeles, told The Wall Street Journal. “This is not a market that 5% interest rates are going to scare at all.” The Calculated Risk blog suggests one reason why is that we’ve seen an increase in household formations–i.e., people who get married or have babies or leave their parents’ home. They’ll pay the price if it means getting a new space. Meanwhile, the National Retail Federation and other sources say America’s ports continue to handle record volumes of goods, and China’s COVID crackdown continues to make delivery times uncertain. In other words, the future looks much like the present. The second–a recession–carries the harshest impact, but you’re most likely to know what to do if it occurs. A lot of you sketched out plans for a drop in sales when COVID first struck, only to shelve those plans when sales suddenly rebounded. And if you were around during the Great Recession, you know even more about how to respond. A third, murkier scenario should explore what to do if our nation enters a period of stagflation–a time when the economy barely sputters along while prices keep rising and unemployment rolls grow. The United States suffered from this condition in the 1970s, in large part from that decade’s Arab oil embargo, and it took pretty much the whole decade to come out of it. High-growth states with lots of new-home construction might avoid this trap, but other regions could find rough conditions for quite a while. To these three I would add a fourth possibility: A new “normal.” In this scenario, the pace slows from pell-mell down to merely brisk. There’s enough supply moving through the pipeline that months-long waits vanish and constant updates to customers about delivery times go away. Prices remain higher than they were pre-COVID, but volatility decreases. Investments in e-commerce continue to pay dividends. The work pace gets more comfortable. Life would be much easier if construction supply companies could clearly see what’s on the path ahead, but that’s definitely not the case today. It’s best to be prepared. We can help you plan for these and any other scenarios you’d like to consider.

Women Are Moving Out of LBM’s Back Row.

I Talk to Two Women About Their Journey

Small steps deserve recognition even when the journey is long. That’s how you could describe the gains the construction industry has made in attracting more women to our ranks. This month, in Door + Window Market magazine, I showcase two women who hold VP roles in our business: Laura Basara of Lamatek and Jennifer Castenson of Buildxact. Both say that women can enhance a company’s operations because of the skills and traits women can bring to a job. Both have experienced prejudice, but say those moments are minor ones compared with the support they’ve received. And both endorsed the value of having mentors to help them grow professionally.

M&A Volume Hasn’t Dropped Much in ’22,

But the Size of the Deals Sure Has

By Craig Webb, President, Webb Analytics

If LBM’s Mergers and Acquisitions market were a baseball game, you could say this season is featuring a lot of singles and doubles compared with last year’s home runs and grand slams. Through June 15, Webb Analytics has recorded 52 deals by 30 buyers that involved 138 locations of construction supply facilities nationwide. Compared with last year, that’s about the same number of deals (54 by this point in 2021) and slightly fewer buyers (34). But this year’s average acquisition involved 2.7 facilities while the average last year to date was 5.2. This year, the biggest single buys were when Gulfeagle Supply bought R&S Supply’s 24 yards and Builders FirstSource acquired 19 locations from National Lumber. In contrast, by this time last year we had seen US LBM taking on 79 locations from American Construction Source and another 43 locations from Higginbotham Bros. The first five months in 2021 also saw R.P. Lumber absorbing the 24-branch Stock+Field chain, and SRS Distribution making four deals that brought it five, 11, 12, and eight branches, respectively. Greenfield openings have been more active this year than last, with 57 already accomplished vs. 50 in 2021. In addition, at least 12 other facilities are set to open by Dec. 31 of this year. On the other hand, we already know of 13 closures this year, compared with just seven by this point last year. Among recent acquisitions, Nation’s Best Holdings took over the four Sparr Building & Farm Supply units in Central Florida as well as California’s Calaveras Lumber and Sonora Lumber; Blue Ridge Lumber bought the two-branch, Pennsylvania-based Cramer’s Home Building Centers; Beacon Building Products acquired Wichita Falls (TX) Builders Wholesale; Waters Hardware bought seven Nuts and Bolts hardware branches in Missouri; and Kansas; and W.E. Aubuchon acquired Cornell’s Hardware of Eastchester, NY. More recently, Gulfeagle Supply bought Long Island-based BrightView Distribution, fast-growing Ambassador Supply bought Astro Buildings, and Southeast Building Supply Interests (a division of Building Industry Partners), bought Wallace Building Supply of Tennessee. The list of greenfield openings in recent weeks includes ABC Supply in Tiffin, GA; ABC Supply’s L&W Supply subsidiary in Plymouth, MN; R.P. Lumber in Mount Vernon, MO; and Floor & Decor in Warrensville Heights, OH. In addition two truss plants opened recently: A-1 Industries in Bainbridge, GA; and US LBM’s Brand Vaughan Lumber in Lithonia, GA.

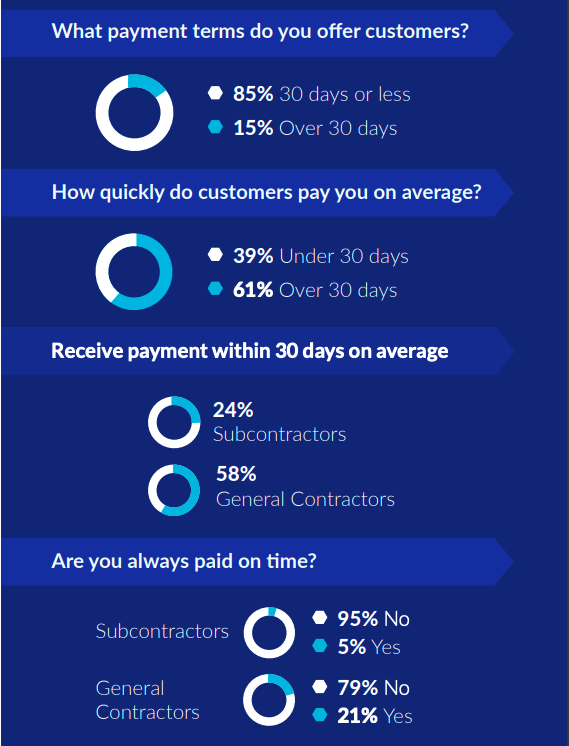

Payment Speeds and Collection Costs Always Matter. With Inflation, They Matter Even More

Three reports issued in the past month combine to deliver an important reminder: Good dealers are efficient at collecting the money due them. Levelset’s latest Construction Cash Flow & Payment Report helps set out the problem. The company’s survey of 519 general contractors and subcontractors, 75% of whom work in residential construction, suggests that pros are slow to pay dealers because the pros aren’t getting paid on time: While 85% request payment within 30 days, only 58% of GCs and 24% of subcontractors get paid that quickly. In other words, even if a contractor pays a dealer as soon as he gets a check from a customer, it’s likely that the pro’s payment won’t reach the dealer within the 30-day time period. Paying online could cut the delivery time. But according to Webb Analytics’ Construction Supply 150 report, only 59% of America’s biggest dealers have systems in place for customers to pay online. Another 24% said they plan to get such a service. Given that the Construction Supply 150 focuses on big companies, the actual percentage of dealers with electronic bill-paying capabilities is likely to be much lower. The sooner they change, the better, because Postmaster General Louis DeJoy has warned that several “uncomfortable” postage rate hikes are planned for the next several years to help the U.S. Postal Service become financially stable. That is certain to raise the cost of collection. DeJoy also has revealed changes in the works that will slow delivery of first-class mail by a day or more depending on how far the letter has to travel. Minimizing the number of days that invoices take to get paid is a logical goal for all seasons, but this goal becomes more important in times of inflation, when lending costs rise with each passing day. Odds are, potential investors will take note of this when they value a potential acquisition.

As Production Builders Get Ever Bigger,

Dealers’ Role as Supply Partner Shifts

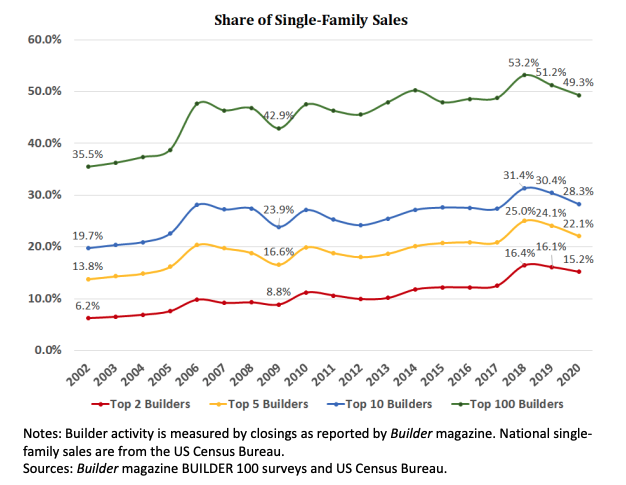

America’s homebuilding industry is more concentrated than ever before, with 100 companies accounting for half of all construction, up from one-third 20 years ago, a new study reveals. But that same study’s authors also predict that housing won’t ultimately see the kind of massive consolidation seen with autos, airlines, department stores and other major industries. Concentration in the Homebuilding Industry: Trends, Strategies, and Prospects, issued April 19 by the Joint Center for Housing Studies of Harvard University, credits the change to several factors. First is the growing market share of D.R. Horton and Lennar, which together have more than one-seventh of the entire housing market and which rank either No. 1 or No. 2 in 37 of the 50 biggest markets. Second is the emphasis that the nation’s 10 biggest builders have placed on building in America’s 50 biggest markets; in those places they collectively have a 38% market share vs. a 28% share for all homes built nationally. ‘The growth of the top two builders has accelerated in recent years and they may achieve an even more commanding position in the industry in the future,” authors Gopal Ahluwalia, Kermit Baker, and Kent Colton wrote. “But despite their dominant presence in major metro markets, the overall level of concentration in the homebuilding industry remains well below that in many other major industries. … “[R]egional builders have shown that they can compete effectively with national builders, particularly in the smaller top 50 metro areas,” the authors continued. “Many of the scale benefits of homebuilding–buying power with local suppliers, coordination of subcontractors, investment in technology, and even some elements of the land assembly and entitlement process–play out principally at the local level.” The report’s implications for dealers–and for investors judging those dealers–will vary by market and by company focus. Only a few dealers–most notably Builders FirstSource and 84 Lumber–pursue national builders on a national scale. Lots of smaller, regional dealers cater to their market’s branch of the big powers, and most also reach out to regional and smaller dealers. Responses to Webb Analytics’ Construction Supply 150 report found that only dealers with revenues above $1 billion got a bigger share of revenues from production builders of any type than they did from custom builders. By contrast, dealers with $250 million or less in annual revenue said they got up to 40% of their sales from custom builders.

Based on What Peers Are Saying, Your LBM Operation May Be Better at ESG Than You Think

If you read opinion columns in The Wall Street Journal or listen to critics on CNBC, pushing companies to meet Environmental, Social and Governance (ESG) criteria will hurt their performance worse than forcing a marathoner to run in lead boots. But several recent announcements by a trio of big dealers show how things dealers have been doing for business reasons can be highlighted in an ESG report card. Builders FirstSource’s ESG statement notes that its manufactured framing components “make framing greener, with more than 3 million trees saved since 2019.” It touts how its Ready-Frame system enables builders to put up homes more efficiently with less waste and on a safer jobsite, and reports that it has installed LED lights and bought electric-powered forklifts. Being a private company, US LBM doesn’t have to issue an ESG statement, but it took advantage of Earth Day to issue a press release noting that it sells products that improve the energy efficiency of homes. In addition, it cited how route-planning technology cuts emissions and fuel consumption across US LBM’s fleet. Beacon’s first ever Corporate Social Responsibility report, issued in February, cited its growing OTC Network–basically, a system of interconnected branches–as a way to reduce unnecessary driving and fuel. The company also created a “women in roofing” award. While such activities might seem like the ESG version of greenwashing, these companies do appear to be pushing ESG issues harder than many other dealers. For instance, Beacon declared its intent to halve its carbon emissions intensity by 2030. US LBM says it’s the first full-line building products distributor in the U.S. to participate in the United Nations Global Compact, which it described as “a voluntary initiative in which companies commit to aligning their business strategies and operations with 10 universal principles related to human rights, labor, anti-corruption and the environment.” And BFS is collecting and calculating the emissions and energy consumptions at its five biggest locations. it hopes to be able to quantify and disclose its total greenhouse gas emissions by 2023.

Key Benchmarks Here

I’m happy to share with you The Construction Supply 150 report. This 52-page report examines the size and scope of the companies that together account for arguably three-quarters of all LBM sales in the United States. No other report on pro dealers is as comprehensive. I’ve made it easy for you to download this resource. Just click here, enter some informatiion about yourself, and the report is yours.