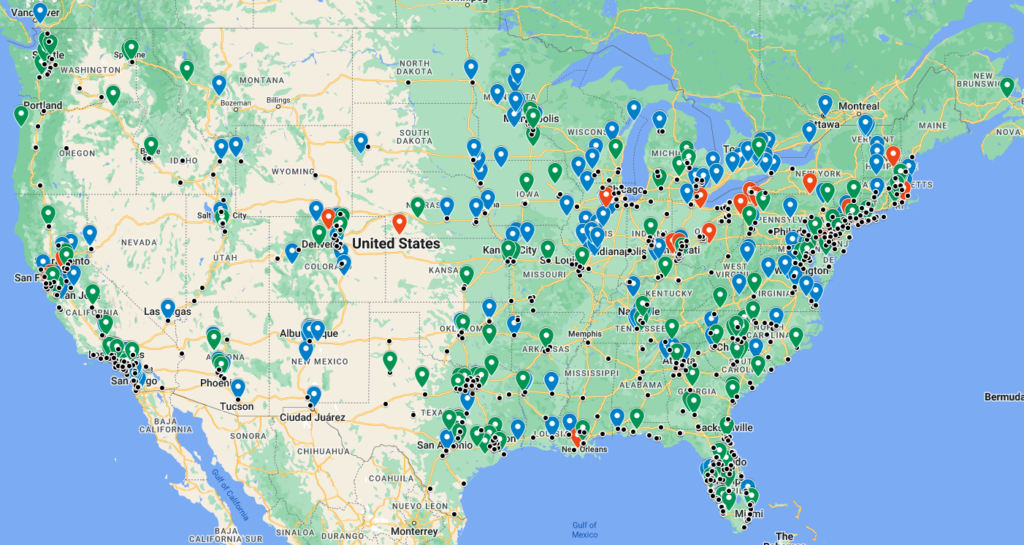

The map above shows facilities acquired (blue pins), newly opened (green pins) or closed (red pins) so far this year, while the black dots show SRS Distribution facilities acquired by The Home Depot. The nearly 200 facilities acquired by 47 buyers in 79 deals is about on par with 2023’s pace. We also have had 100 greenfield openings that have taken place, with about three dozen more announced for this year but not yet opened.

Will we also have another megadeal this year to rival The Home Depot’s? The answer could depend on what QXO does. The investment vehicle led by Brad Jacobs announcedJune 13 that it secured $3.5 billion in private placement financing. That’s a lot of dry powder for use in QXO’s plans to create a multi-billion-dollar building products distribution company.

The Home Depot’s announcement overshadowed more than a dozen other acquisitions announced since mid-May:

- Kodiak Building Partners bought Simonson Lumber, which has seven locations in Minnesota.

- US LBM expanded in New Mexico by acquiring RAKS Building Supply, which has five locations in the state.

- R.P. Lumber bought Thorne Lumber, which has three locations in northwestern Missouri.

- SiteOne Landscape Supply purchased Hardscape.com, which despite its name has four physical locations in Florida.

- Gillman Home Center bought Goecker Building Supply of Seymour and North Vernon, IN.

- Zuern Building Products took in Saeman Lumber of Cross Plains, WI.

- ABC Supply’s Town & Country Industries division acquired Aluminum Products Wholesale of Mobile, AL.

- The Lester Group bought Custom Builder Supply of Williamsburg, VA.

- Truckee-Tahoe Lumber added a truss operation by acquiring NVO Construction Components of Reno, NV.

- Nation’s Best Holdings took in Reece’s Building Supply of Narrows, VA, its second yard in the Old Dominion.

- GMS expanded in Canada’s Ontario Province by buying the seven-unit Yvon Building Supply.

- Lugbill Supply Center absorbed Affiliated Lumber & Building Materials of Swanton, OH.

- Elder’s Ace Hardware bought Schofield’s Ace Hardware of Florence, SC.

- Timberline Enterprises bought Northeast Building Supply of Hanson, MA.

Among greenfield store openings:

- ABC Supply opened stores in Batavia, OH; Shelbyville, KY; Chandler, AZ; Hainesport, NJ; Lancaster, PA, McAlester, OK; and Oklahoma City. Meanwhile, ABC’s L&W Supply division set up shop in Jacksonville, NC, and Lubbock, TX.

- Beacon opened stores in Terrell, TX; Attleboro, MA; Missisauga, ON; Everett, WA; and Spokane, WA.

- McCoy’s Building Supply celebrated the opening of a new store in Lockhart, TX.

- The Home Depot opened a new store in Wildwood, FL.

- Builders FirstSource set up a new Dixieline Lumber store in Capistrano Beach, CA, at a former Ganahl Lumber site.

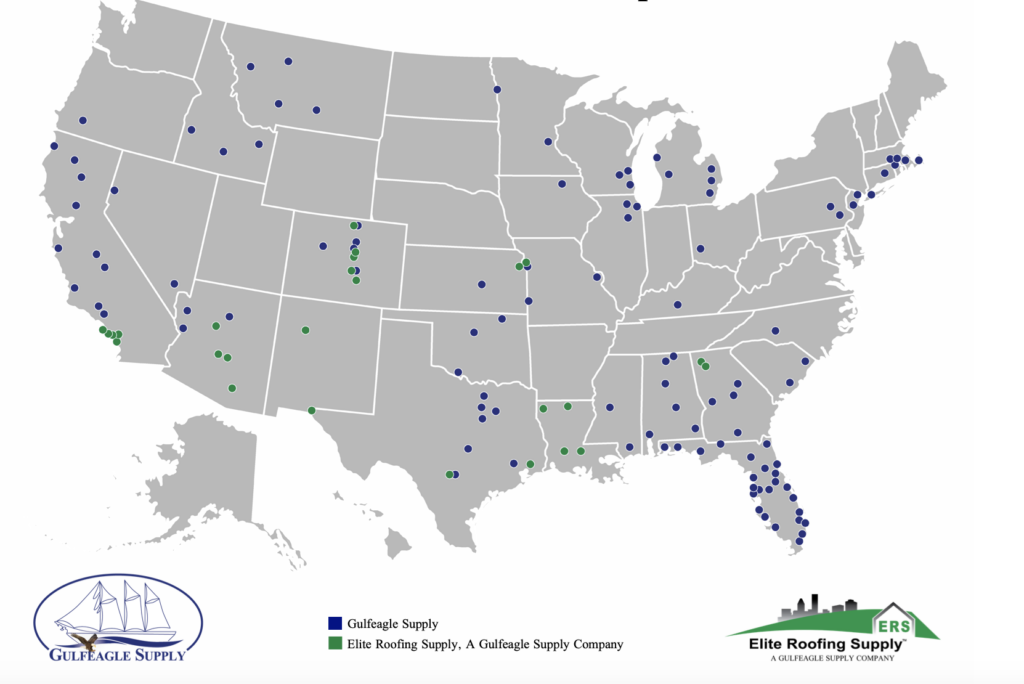

Also noteworthy: Gulfeagle Supply announced the completion of its acquisition of Elite Roofing Supply. With 27 locations mainly in the western U.S., Elite Roofing is one of the biggest companies to be acquired this year outside SRS.