By Michael Collins, Managing Partner, EquiNova

February 2023

Managing Principal Walt Kurek and I used up lots of shoe leather in Las Vegas earlier this month while visiting the International Builders Show and other events that made up Design and Construction Week. Given the acres of booths and nearly 200,000 attendees, there were lots of products to see and people to meet. Our dozens of conversations yielded a general consensus about prospects in 2023: Some are seeing softening demand, but conditions remain strong enough to generally feel optimistic. Put another way, some expect business to be a bit down from 2022 but a bit up from 2021.

Such optimism might seem misplaced at a time when mortgage rates have more than doubled, the stock market is turbid, and big builders are giving incentives to buyers. The National Association of Home Builders (NAHB) predicts single-family starts will decline 25% this year and multifamily will drop 28%. But you need to remember that there were 1.68 million privately owned housing units under construction nationwide as of December. That’s 45% more than we had in December 2019 and the second-highest number in 42 years; only November 2022 was bigger. It will take months to complete all that work, so manufacturers and building material dealers can expect robust demand at least through the first half of 2023.

After that, what? The drop in starts early in 2023 ultimately will result in reduced demand for goods, but there are indications the underlying slump will be relatively short. The jobs market was unexpectedly strong in January, and anecdotal reports in recent days suggest demand is returning now that the Fed is tapering its interest-rate increases. NAHB’s forecast ultimately might be too dire; the prediction by Stifel’s Keefe, Bruyette and Woods division calls for only an 11% decline in single-family this year, along with a 14% rise in multifamily.

Even better, NAHB and others predict 2024 will be much stronger. America remains underbuilt, and demographic factors, relocation patterns, and the work-from-home phenomenon continue to promote long-term desire for homes. Those are the kinds of numbers that investors like to see.

We hear reports that growth-oriented companies are seeing in these conditions an opportunity to acquire companies that are enjoying modest success now and possess long-term potential. We can help you become that type of business, as well as find a partner that can help fill your glass far more than halfway.

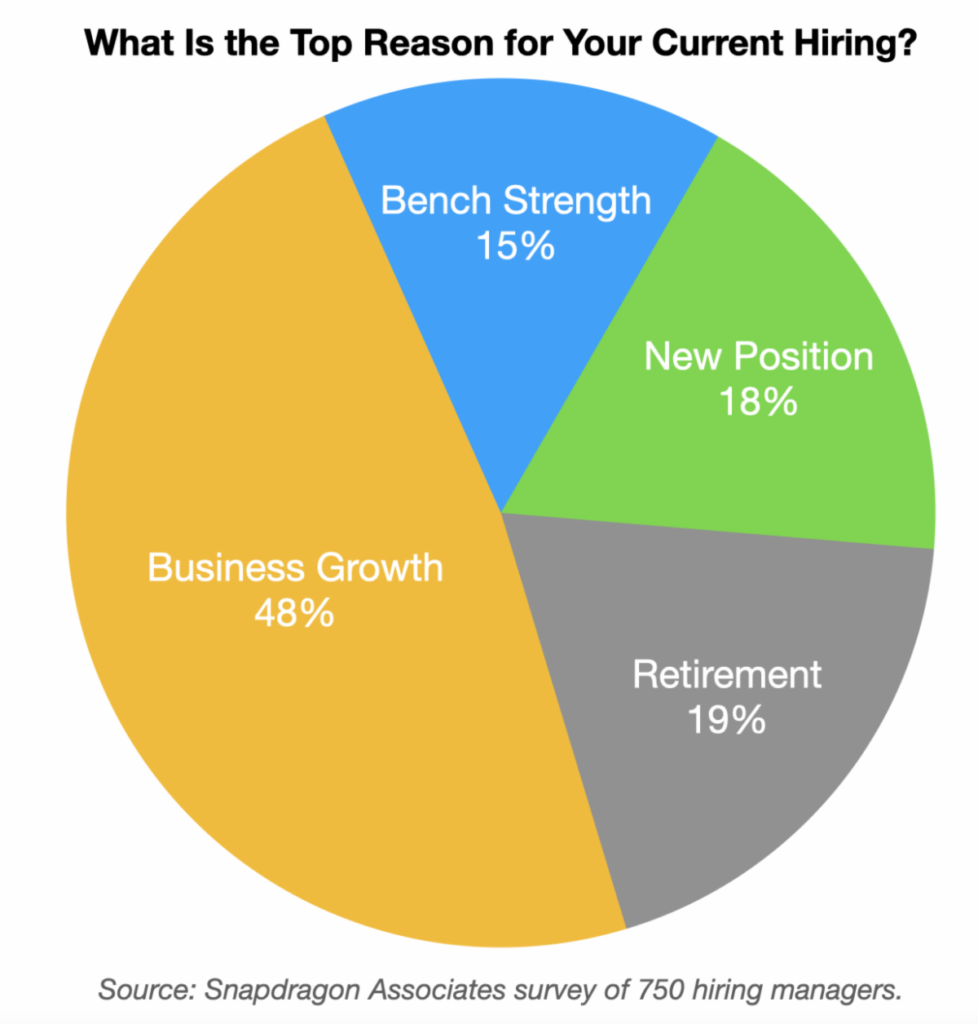

Dealers’ Hiring Intentions Show They’re Bullish

Just after IBS, Mark Barnard of Snapdragon Associates shared with us the results of his recent survey of 750 hiring managers. The survey found two-thirds of all hiring is taking place because the companies want to grow, either by beefing up existing departments or by creating new roles. “Most feel that business is there, and if things settle down on the interest rate side, we should be seeing improvements in Q2 or Q3 this year,” Barnard told us. He also pointed out that the percentage of hiring meant to replace a retiree is double what it was a few years ago. Regard that as a sign the pace of baby boomer retirements is accelerating.

US LBM’s Sale of Drywall Units to L&W, Greenfield Opening Plans Top Early ’23 News

By Craig Webb, President, Webb Analytics

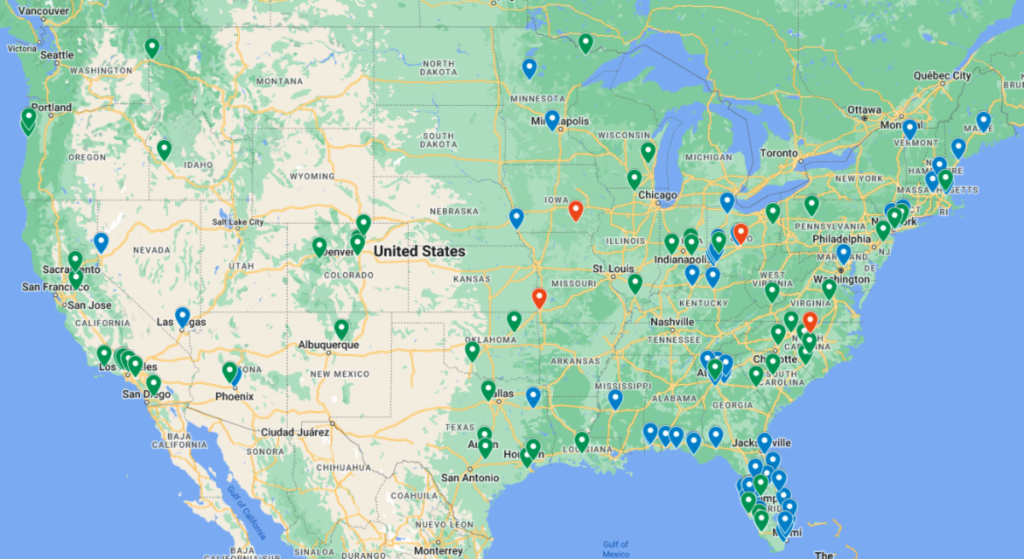

Six weeks into 2023, we already have seen one transaction that’s far bigger than anything done in 2022, as well as announced intentions to open 60 construction supply companies and hardware stores before this year is out.

The major deal has US LBM selling its drywall specialty divisions to L&W Supply, ABC Supply’s drywall-focused division. The 46 locations (by Webb Analytics’ count) carry the banners of Coastal Roofing Supply, Feldman Lumber, Richardson Gypsum, Rosen Materials, and Wallboard Supply. Operations in 12 states are involved, but the biggest changes will be in Florida, where 26 of the 46 stores are located.

The US LBM-L&W Deal is one of 11 announced so far this year, involving 11 different buyers. Others reported since mid-January have SRS Distribution buying Marsh Building Supply’s seven locations; Nation’s Best Holdings acquiring East Texas Hardware of Kilgore, TX; and Central Network Retail Group’s Frattallone’s Hardware buying Everson’s Hardware of Waconia, MN.

Early 2023 has featured an unusual number of announcements by dealers regarding plans to open facilities. Most prominent was 84 Lumber, which declared it was going to open components plants in Florida, Georgia, South Carolina, Idaho, Massachusetts, and New Jersey, plus lumberyards in Stockton, CA, Denver, CO, and Greeley, CO, and a door shop in Denver. Atlantic Group opened a truss plant in Fairmont, NC, and Kapers Building Material is putting a truss operation into a corrections facility in Greencastle, IN.

Other lumberyards slated to open this year are Copeland Do it Best Lumber in Lincoln City, OR; Three Bears Alaska in North Pole, AK; Drexel Building Supply in Kewaskum, WI; McCoy’s Building Supply in Lockhart, TX. The move in Lincoln City relates to plans by Builders FirstSource to open a yard in South Beach, OR, that will consolidate its soon-to-be closed Lincoln City and Newport, OR, yards. BFS has similar plans for a new yard in Carbondale, CO, which when completed will contain operations relocated from Aspen, Glenwood Springs, and Basalt, CO.

Ask me about deals, planned openings, and closures of hardware stores.

Now Available: A Deals Roundup For All 2022

Webb Analytics has published its latest Deals Report, this time covering construction supply acquisitions, greenfield openings, and closures in 2022. The report is free and can be downloaded as a PDF here.

The Deals Report combines maps, charts, graphics, and text to chronicle what happened to 762 construction supply facilities and hardware stores that saw changes last year. It’s the most complete free available report on LBM M&A .

Construction Supply Logistics Leaders See Conditions Improving After 2 Fraught Years

The supply chain will have far fewer kinks this year than it suffered the previous two, but challenges remain, particularly in finding talent, a panel of supply chain experts said at a Feb. 1 panel during the International Builders Show.

“We think we can get back to 95%-96% fill rates by year end,” up from 75% at the worst point in 2021 and 85% by the end of 2022, Jeff Curler, the Executive Vice President for Purchasing at Orgill, said during the panel, part of World Vision’s Crystal Vision Award Breakfast. Fill rates for the company’s private-label brands already are near 97%, he said, but paint and plumbing products–especially products made from resins–remain trouble areas.

Zach Elkin, President of Beko Home Appliances USA, said his company had to quadruple its parts inventory to make certain it had readily available replacement and repair parts for its machines. The company also tripled its warehouse space in Chicago and added distribution centers in Florida and Texas. Ultimately, the company aims to have a manufacturing facility in the United States so that it’s less dependent on ports and long supply chains, he said.

Joe Barnes, Executive Vice President for Sourcing and Supply at Builders FirstSource, said he is focusing on helping customers reduce overall sourcing costs. For instance, BFS shares information with suppliers and customers to help all parties recalibrate to the right demand levels.

Kohler’s 160-year history helped Shawn Oldenhoff, President of the Kitchen and Bath division, draw upon lessons in resiliency, SKU rationalization, product choices, and continued investment. “You need to continue to build vitality in your portfolio,” he said. But he also admitted life hasn’t been easy, remarking: “In the past three years, I’ve gone through a 30-year career.”

Jeff Kinnaird, The Home Depot’s Executive Vice President of Merchandising, voiced similar sentiments. “We’re thrilled that we’re not leasing or chartering vessels any more,” he quipped, referring to the extreme measures THD used to bring products to America. The Home Depot long engaged in Just in Time shipping practices, but during COVID had to move to a Just in Case scenario that filled its warehouses. Now the trend is swinging back, he said.

All agreed that finding good employees is hard but necessary work. Using remote workers has become “a way of life,” Kinnaird said. Barnes said he devotes half of his time working with current staff or finding new ones, and he noted that BFS has adjusted its policies and pay to keep up with the times.

Jim Inglis, a consultant to Do it Yourself stores worldwide, served as moderator.

Check Out Equinova’s Updated Website

You’re invited to visit our newly updated website, equinovacapital.com, and get a better sense of how we provide M&A advisory services and private equity capital to middle-market companies. The site has sections introducing you to our team, details on the services we provide, and a list of transactions we’ve done.