By Craig Webb, President, Webb Analytics

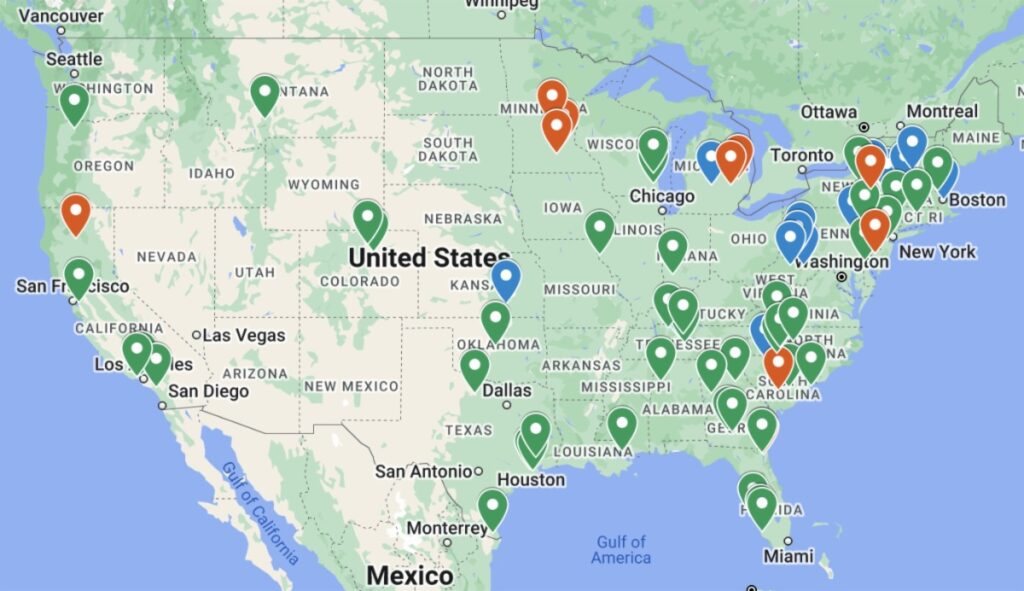

By mid-February last year, we had learned of 27 acquisitions involving 40 facilities. This year, only nine deals affecting 14 locations have been posted. The biggest to date has Builders FirstSource buying O.C. Cluss’ four yards.

Meanwhile, US LBM did two single-yard deals, both of them strategic. US LBM’s purchase of highly regarded Walker Lumber of Nashville, TN, brought it its first yard in the Volunteer State. And US LBM’s takeover of Goodrich Bros., a hardwood moulding specialist located between Lansing and Grand Rapids, MI, will boost its value-added revenue in the state.

Elsewhere, 84 Lumber expanded its truss capacity twice over. First, it opened a components plant in Newark, DE, that it had purchased in mid-2024. And then it bought Tri-Country Truss of Bloomsburg, PA. Historically, 84 has preferred to build its own facilities from scratch. These purchases plus another last year suggest it’s building its components capabilities at an accelerated pace.

The other lumber-related deal this year saw Curtis Lumber buy JAY-K Independent Lumber Corp. of New Hartford, NY. As part of the takeover, Curtis will close its yard in nearby Waterville, NY, and merge it into JAY-K’s facility.