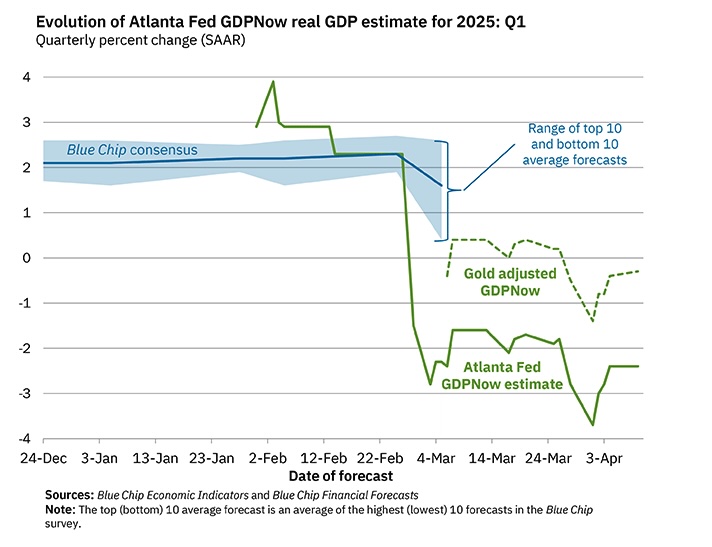

One of our favorite direction signs for the entire U.S. economy is GDPNow, produced by the Federal Reserve Bank of Atlanta. In essence, GDPNow takes all the indicators used to figure the Gross Domestic Product and, as soon as they are announced, plugs them into a model that predicts what the quarter’s GDP will be when all the indicators are in. Last year, GDPNow consistently was a better predictor than a panel of economists. In 2024, it indicated the economy was doing better than the experts’ forecast. Now we’re getting signs the actual GDP number will end up worse than economists had expected–even after their downward revision earlier this month.

+++

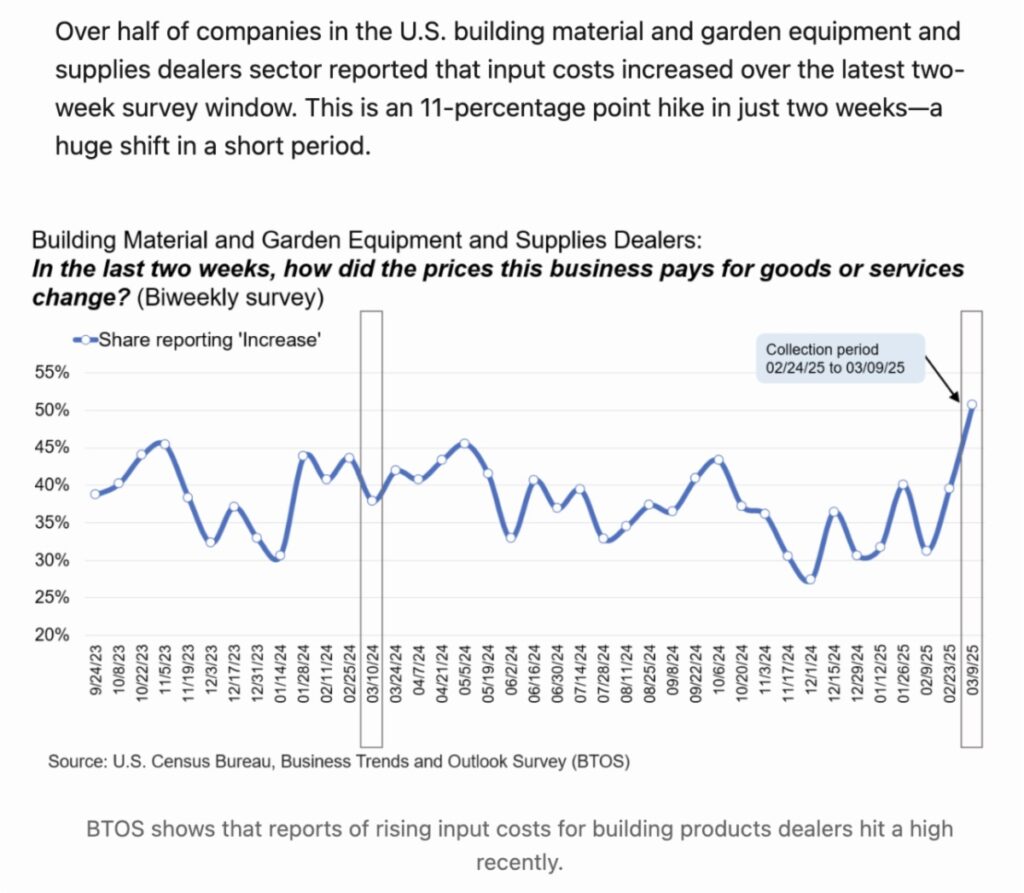

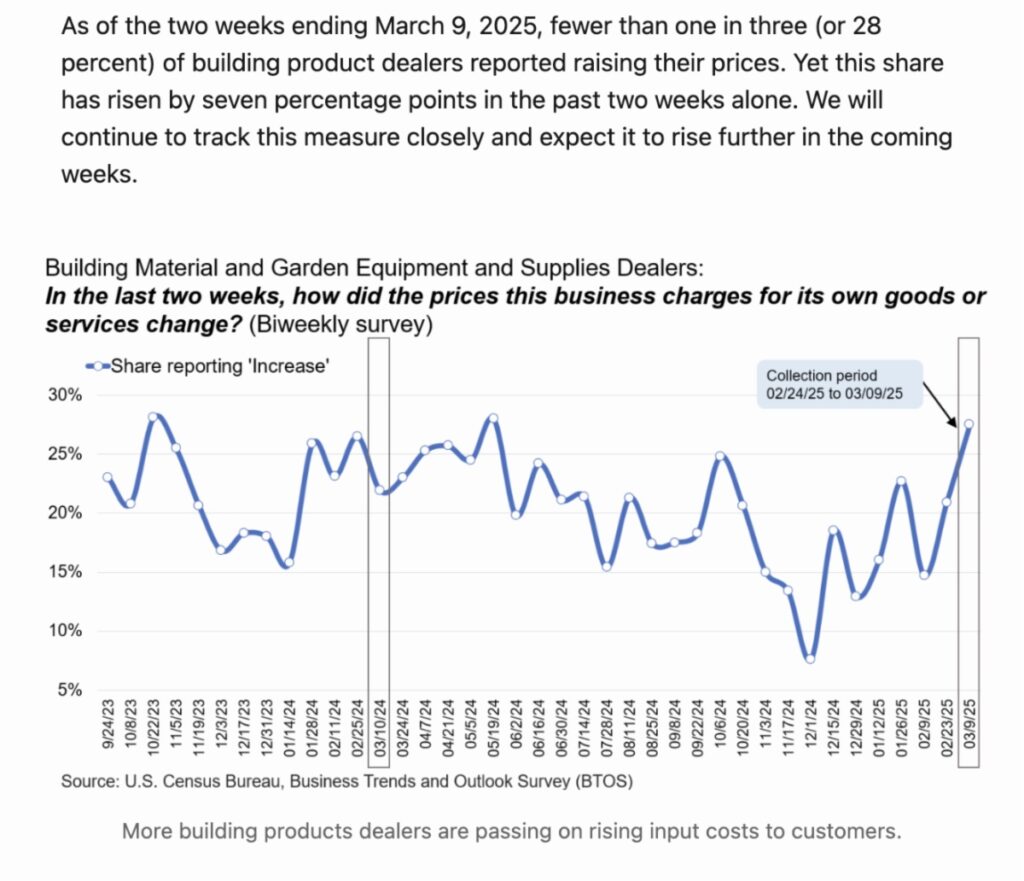

These next two charts go together:

Most quick survey results are based on a small sample size. The Census Bureau’sBusiness Trends and Outlook Survey compiles its results biweekly from roughly 1.2 million businesses. The charts above reflect information collected through March 9. Future surveys should provide solid information about price changes in the building material sector.

+++

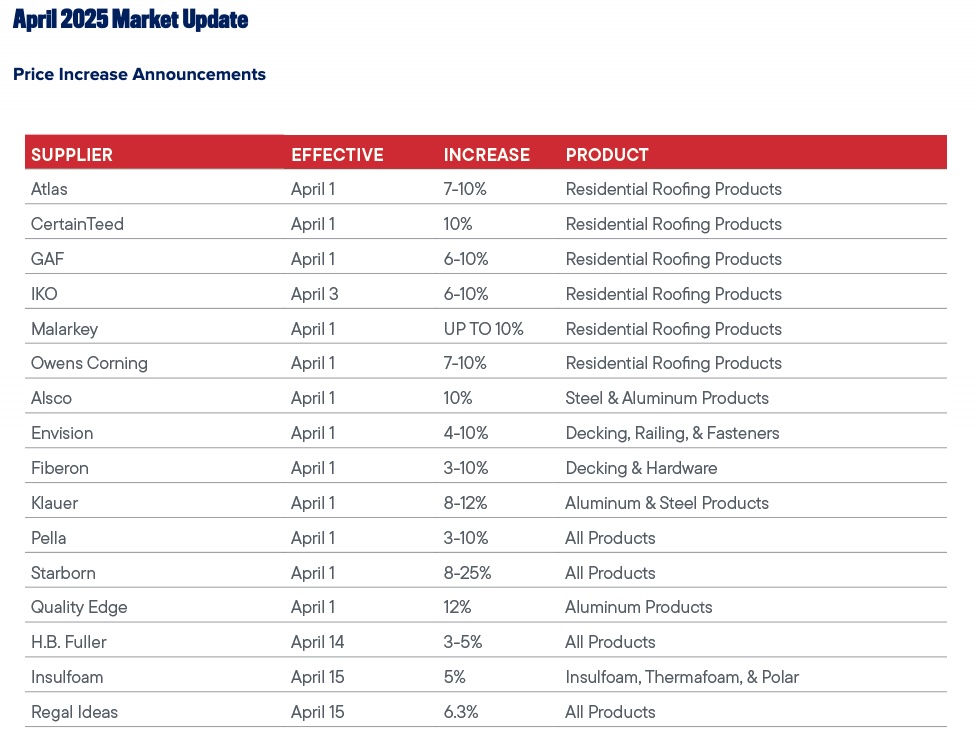

The Census Bureau’s Business Trends and Outlook Survey spans all companies involved in building materials supply, from the biggest of big boxes down to tiny hardware stores. If you want data that’s more specific to pro-oriented dealers. You have to look around. One place to look is the monthly Market Update report from Dealers Choice, an exteriors product distributor owned by Beacon. Will these announced price increases stick? Dealers Choice expects they will.

+++

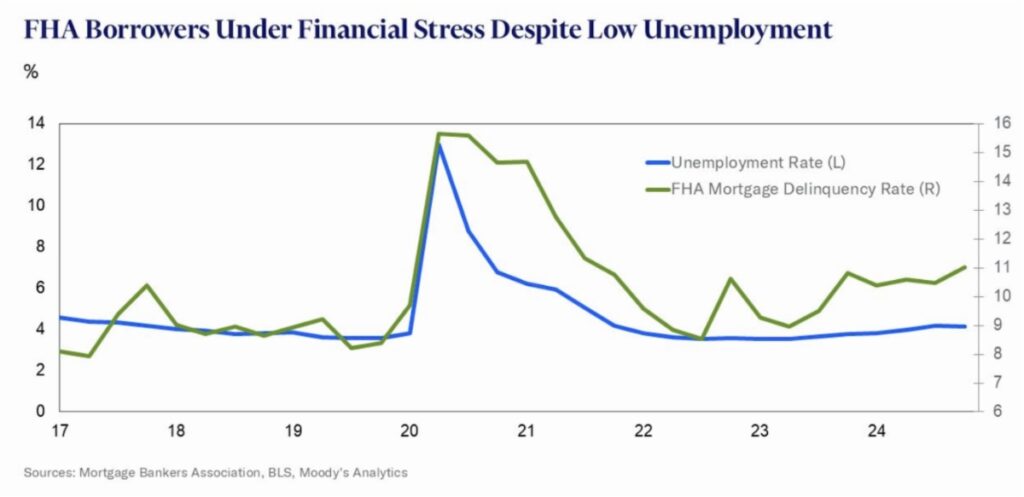

Mark Zandi, Chief Economist at Moody’s, thinks this typically overlooked economic indicator “may be a proverbial canary in the coal mine” regarding the potential for a recession. The chart above compares the unemployment rate with the FHA Mortgage Delinquency Rate. Zandi notes that borrowers getting assistance from the Federal Housing Administration have a median income of $75,000 and often are first-time buyers. The recent increase in the delinquency rate, despite relatively low unemployment, suggests “these households are under mounting financial stress,” Zandi wrote.

+++

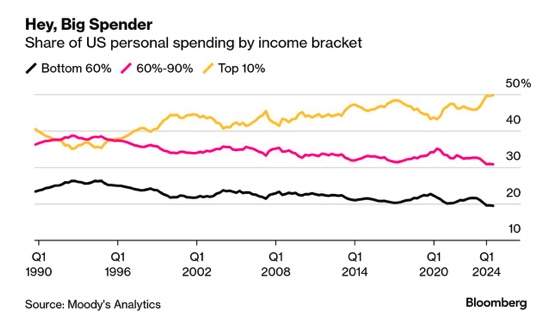

On the other hand, another Moody’s Analytics chart says spending by the top 10% of Americans now represents half of all personal spending in the U.S. (Here’s how the Marketplace radio show reported it.) For construction and remodel spending, anecdotal reports from dealers suggest the story is likely the same: Most big-ticket business today is coming from wealthier households.