By Michael Collins, Managing Director, EquiNova

April 2023

Poring over the latest economic reports, we were reminded that housing across America is distinguished more by its differences than by its similarities. Since late 2019, the number of homes under construction is up 130% in San Antonio and down 62% in San Jose, up 112% in Sarasota and down 34% in Seattle. Lumber dealers in March sell 2x4s worth roughly half what they were a year earlier, according to the Producer Price Index, while concrete dealers have seen their core product climb 14% in price. Dealers that serve single-family builders fret that single-family housing starts are dropping, while dealers that sell to multifamily builders feel much more confident they’ll remain busy.

Every market is different, and every dealer within that market is different. That’s why asking friends about the latest EBITDA multiple they’ve heard rumored recently is unlikely to give you much of a gauge for valuing your own company. You need much more, particularly:

- A detailed analysis of your market’s current economic health, as well as its future prospects;

- An X-ray of your company’s financial health that most likely will scrutinize you far closer than you typically do;

- An assessment of the leadership team you would be leaving in place along with the physical plant; and

- An outside expert’s opinion on WHY you’ve done so well over the years, and whether the factors that created your success will continue after the acquisition.

This need for detail helps explain why EquiNova produces reports thick with dozens of pages when we represent a dealer in a sale. It takes that many pages to tell your story.

Yes, there are tidal ebbs and swells in what investors will pay for an LBM operation, but we believe that the variations between markets and between dealer operations produce far bigger differences in a company’s value. We can help spot the details that make the difference on signing day.

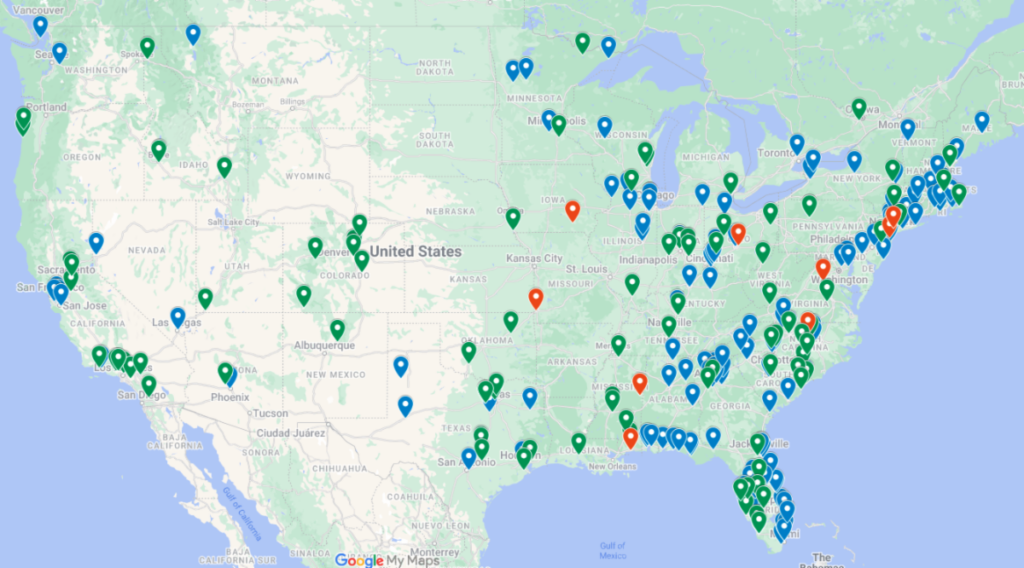

LBM M&A Activity Through April Beats ’22 Pace

Thanks largely to deals involving drywall specialists, overall M&A activity in construction supply so far this year is showing robust numbers compared with what had occurred by this point in 2022.

So far, there have been 41 deals involving 37 buyers that involved a total of 188 facilities. That’s bigger than 2022’s 136 facilities that changed hands through late April. But the number of greenfield store facility openings is almost exactly the same–79 this year, 80 last year–and so is the number of closures–11 this year vs. 12 in 2022.

More than half the facilities purchased were in the drywall space:

* Foundation Building Materials purchased MarJam Supply, bringing it 32 new locations scattered across 10 states.

* GMS purchased Engler, Meier & Justus, which has eight operations in Illinois, Georgia, and North Carolina.

* L&W Supply, the gypsum specialty division of ABC Supply, purchased US LBM’s drywall specialty operations. The deal brought L&W 46 locations, of which 26 are in Florida and the rest are in Alabama, Georgia, Arizona, Nevada, New York, Connecticut, Massachusetts, Vermont, New Hampshire, and Maine. Late in April, L&W also purchased Old Fort Building Supply of South Bend, IN.

GMS also announced recently that it purchased Canada’s Blair Building Materials of Maple, ON, and opened a greenfield location of D.L. Building Materials in Ottawa, ON. In addition, GMS this year has opened a branch of New England Gypsum in New York City and three AMES Taping Tools stores in Concord, NC; Olive Branch, MS; and Myrtle Beach, SC.

Among the other notable actions since mid-March:

* R.P. Lumber sold to Runnings its two dozen R.P. Home + Harvest stores. R.P. had purchased these stores in 2021 after their previous owner, Stock+Field, filed for reorganization under Chapter 11 of the federal bankruptcy laws.

* Nation’s Best Holdings bought Mountain View Hardware in King, NC, and Patrick Building Supply in Stuart, VA.

* Ambassador Supply took over Hitek Truss of Brooksville, FL, while Oxford Group acquired Appalachian Truss of Burnsville, NC.

* HPM Building Supply bought 87ZERO, a cabinetry specialist in Honolulu.

* Beacon bought Al’s Roofing Supply, which has four facilities in California, while Beacon’s Dealer’s Choice Distribution unit acquired Prince Buildings Systems of Neillsville, WI.

* SiteOne Landscape Supply bought the four-unit, North Carolina-based Triangle Landscape Supply.

* Gulfeagle Supply purchased Exterior Supply of Gulfport, MS, then closed its existing Gulfport store and consolidated in the newly acquired building.

* TAL Holdings acquiried the Harbor Rental & Saw Shop, giving it a second outlet in Friday Harbor, WA.

* SRS Distribution opened Suncoast Roofers Supply branches in Tampa and Sebring, FL, and a Superior Distribution branch in Bowling Green, KY.

* SRS Distribution’s Heritage Landscape Supply Group took over Marenakos Rock Center of Issaquah, WA.

* Hardware store purchases included Fairfax (VA) Ace Hardware, North Hall Ace Hardware of Gainesville, GA; and Fremont (IN) Hardware. Among the greenfield openings were D’s Ace Hardware in Largo, FL, and Lant Do it Best Hardware in Nebraska City, NE.

Prior Sales Completed by the Principals of Equinova Capital Partners

Multiple Reports Indicate Construction’s Pace, Supply Chain Has Remained Sluggish

April 18’s announcement regarding a 27.7% year-over-year decline in single-family housing starts in March tended to overshadow a more important current indicator for building material dealers. As the Calculated Risk blog noted, there were 1,674,000 housing units under construction in March when measured on a seasonal basis. That’s only 37,000 less than the all-time record, set last October. It’s a big reason why lots of dealers say they remain busy despite months of declines in permits and starts.

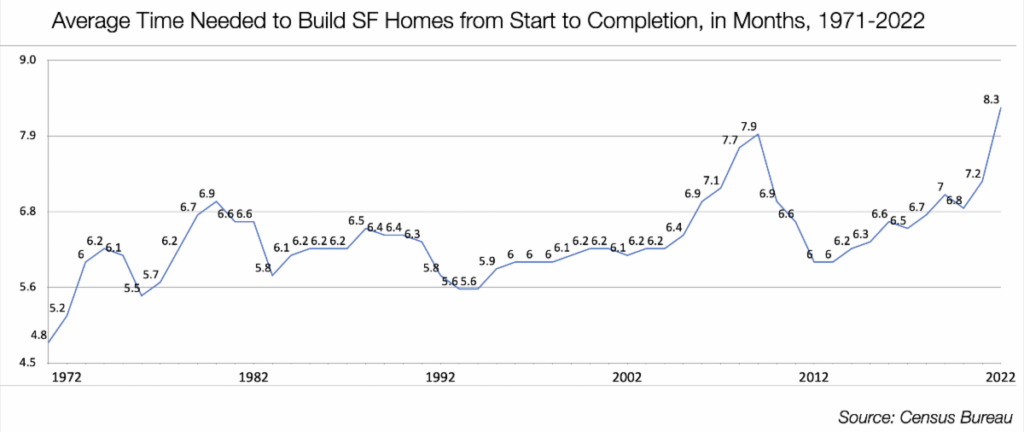

This dichotomy appears to be happening for two persistent reasons: Labor and the supply chain. As the Census Bureau noted in late March, the number of months that it took to build a single-family home in 2022 rose by one month last year, to 8.3. A lack of workers contributed to this 15% increase in building time, but so did challenges with sourcing and delivering products. This year, getting lumber isn’t a problem, but problems finding other products appear likely to persist.

For instance, consider manufactured goods imported from abroad. The Global Tracker Report produced by the National Retail Federation and Hackett Associates says cargo volumes shipped into U.S. ports won’t hit last year’s record levels, but will remain high. Meanwhile, the number of cargo vessels newly commissioned and under order are both going up, portending increases in shipping volume in coming years. Supply-chain experts also are watching closely the ongoing labor negotiations at West Coast ports. The previous contract between the Pacific Maritime Association and the International Longshore and Warehouse Union expired last July 1.

There are challenges in the Heartland, too. BNSF, one of the country’s biggest railroads, noted April 14 that Minnesota’s Twin Cities had had snow on the ground for 111 straight days, while high winds caused service interruptions on its main route between Chicago and Los Angeles. Now it’s keeping an eye on potential flooding from Wisconsin to Montana. Major flooding also is expected in California.

Shipping cycles for roofing products average six to eight weeks, and all manufacturers have announced price increases effective May 16, CAMCO said in a memo to customers. “If shingles ordered cannot be received before May 15, we will sell at the higher costs,” it said. Regional differences in demand also are possible here, as shipments to Florida are up year-over year, while they’ve fallen in Texas and Georgia.

Looking further up the supply chain, a new survey by the American Chemistry Council finds that “the transportation problems plaguing our members are far from resolved,” the association’s economist said in a statement. Sixty-seven percent of companies surveyed said supply chain and transportation disruptions lessened in the second half of 2022 compared with the first half, but 83% said those second-half conditions are worse than what they experienced before the COVID pandemic.

Check Out EquiNova’s Updated Website

You’re invited to visit our newly updated website, equinovacapital.com, and get a better sense of how we provide M&A advisory services and private equity capital to middle-market companies. The site has sections introducing you to our team, details on the services we provide, and a list of transactions we’ve done.