By Michael Collins, Managing Director, EquiNova

July 2023

Along with having to respond to oppressive heat, swampy humidity, and surprisingly strong business from builders, two longer-term issues also are demanding your attention this summer. The first is a continued shortage of personnel that shows no signs of abating. The second is the rise of artificial intelligence (AI) software and the fevered commentary promoting its use. Both issues merit contemplation. Ultimately, I believe they could force us to write new answers to an old question: What’s the right staffing size at a construction supply yard?

With the overall unemployment rate at or near historic lows, we’re seeing construction supply companies loosen their hiring standards and ramp up their recruiting. Hiring someone with a misdemeanor is no longer an issue, and even a felony sheet won’t necessarily bar a candidate from getting a job at an LBM yard. Dealers in some states have stopped pre-employment testing for marijuana, and prisoners on work-release programs are being recruited for component plants and door shops. About the only place standards haven’t dropped is for truck drivers—a job that dealers almost universally say is the hardest one at their company to fill.

The upshot is that investors should review a dealer’s record of attracting, nurturing, and keeping staff when valuing a company, and dealers with high scores in this area should make an effort to point out what they have achieved. The labor shortage isn’t going away anytime soon, so personnel skills in place now will keep paying dividends.

Meanwhile, saying whatever service you offer is “AI-powered” has become a favorite way for a company to imply it’s on the cutting edge. Many times, those claims of newfound AI powers are a stretch, more akin to adding a new top gear to a truck rather than giving it a whole new kind of engine.

Most true AI advances have yet to reach construction supply companies, in part because most dealers haven’t maximized the technology they possess already; witness the scores of dealers that suddenly launched e-commerce stores when COVID struck. But this is also a good thing, because the leading edge of technology is often the bleeding edge. By the time dealers arrive at the point where AI can help them, the cost of implementation will be lower and the benefits will be more obvious.

What kinds of benefits can we expect? Computers and their machine helpers will help you buy smarter, price your goods better, and handle routine tasks faster. Early indications suggest AI will make it possible to do a lot more—and more effectively—with the same number of people, or else maintain current activities with fewer staff. Odds are good that you’ll generate more revenue, and odds are great that you’ll produce higher profits.

Construction supply’s investors and sellers should keep AI in mind when evaluating a company. The potential efficiencies to be gained and/or costs cut as a result of AI could make a deal look much more attractive, and a company much more profitable, as AI becomes ubiquitous in the years to come.

LBM’s Midyear M&A and Store-Opening Activity Runs at Similar Pace to 2022

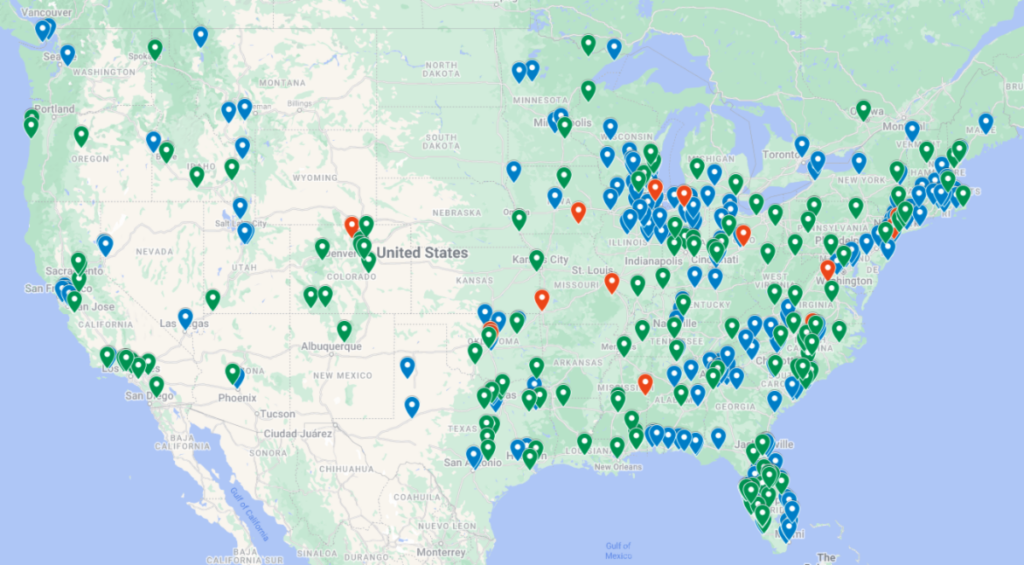

Just over halfway through this year, the construction supply community has seen pretty much the same number of deals and greenfield openings as it did in the opening six months of 2022, with two big deals sharing the spotlight.

Through July 17, we’ve had 237 LBM facilities involved in 65 transactions, versus 257 locations in 84 deals by this point in 2022. There also have been at least 122 greenfield openings by this date compared with 114 at the same time last year. Plans are under way for at least 31 more openings between now and December.

This year’s deals have averaged 3.6 locations per transaction, up from the 3.1 average for 1H22 acquisitions. But two deals account for roughly one-third of all the purchases this year: The first was US LBM’s sale of 46 drywall specialty yards to ABC Supply’s L&W Supply division. The second was Foundation Building Materials’ acquisition of 32 Marjam Supply locations.

The busiest dealmaker has been SiteOne Landscape Supply. Its five deals to date have landed it 17 locations.

Beacon ranked among the busiest companies on two fronts. It made four purchases that brought it 12 locations, and simultaneously opened 14 new locations.

Nation’s Best Holdings did three deals for five locations. L&W also figured in three purchases: Aside from the US LBM purchase, L&W picked up three more yards in a pair of transactions.

SRS Distribution opened 16 new locations, ABC Supply 14, and Floor & Decor 12.

Among notable actions in recent weeks:

* Beacon purchased Crossroads Roofing Supply, which has five branches in Oklahoma.

* Nation’s Best Holdings bought B&S Hardware & Lumber, with branches in Gilmer and Pittsburg, TX.

* Red River Lumber expanded to Idabel, OK.

* SRS took over Washoe Building Supply of Sparks, NV.

* Louisville Tile bought American Olean Midwest’s six facilities in Indiana, Illinois, Wisconsin, Minnesota, and Iowa.

* Studs Lumber opened a new branch in Pagosa Springs, CO.

* Ambassador Supply acquired Straight Line Metal Buildings of Brookshire, TX.

Prior Sales Completed by the Principals of Equinova Capital Partners

Remodelers Care More About a Product’s Availability Than Its Price, New Survey Finds

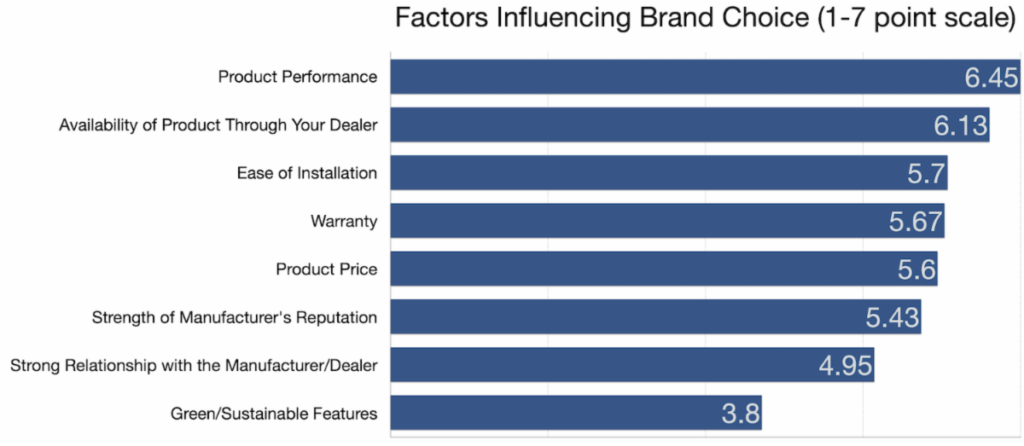

Zonda and its predecessor Hanley Wood have surveyed remodelers every other year for quite a while. Now called the JLC Brand Use Study, the latest poll of 1,132 remodelers delivers this group’s opinions of hundreds of products in 59 building product categories. Among its findings is the chart above, showing which factors matter most to remodelers when they choose a brand. “Product price is only the fifth most important reason respondents gave for choosing a building product,” JLC’s announcement noted. “That said, price does rank as the second-most-important reason residential contractors are persuaded to switch brands, with inventory levels being the top reason.”

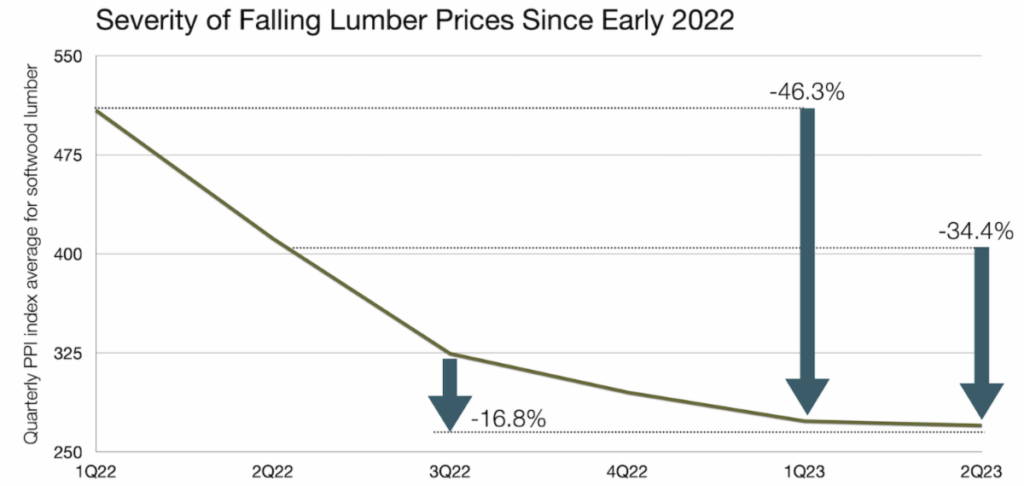

Expect Lumber’s Price Drop Since Early 2022 To Affect Quarterly Earnings Again

Builders FirstSource’s Q1 earnings report revealed how much damage falling lumber prices could inflict on a company’s sales. Its 63% decline in lumber and sheet goods sales played a huge role in the company’s 31.6% drop in total net sales and 4.7.8% decrease in net income.

Now, as we anticipate a new round of earnings reports from BFS and other companies, it’s worth a reminder that the drop in lumber prices since spring 2022 also will affect P&L reports for the second quarter. The impact won’t be as great this time, as suggested by the Bureau of Labor Statistics’ quarterly index for softwood lumber prices (see chart above), but it still will be a drag on earnings.

We probably won’t see anywhere near as large an impact in the third-quarter reports. If you compare the average for July through September 2022 with what we’ve experienced in this year’s second quarter, the decline is smaller at 16.8%. And if widespread expectations of price increases this quarter come true, the increase will shrink the difference with last year even more.

Get 58 Pages of Top-Notch LBM Data

Webb Analytics’ 2023 Construction Supply 150 reveals and analyzes how much America’s key LBM operations changed last year. This 58-page PDF covers 150 LBM dealers, home centers, and hardware chains that in 2022 took in close to $410 billion in the U.S. It also shows how segments of the 150 grew at far different rates they did the previous year. It’s free and available for download here.

Check Out EquiNova’s Website

You’re invited to visit our website, equinovacapital.com, and get a better sense of how we provide M&A advisory services and private equity capital to middle-market companies. The site has sections introducing you to our team, details on the services we provide, and a list of transactions we’ve done.