By Michael Collins, Managing Partner, EquiNova

March 2023

All the news about regional banks might seem like distant thunder for a construction supply industry that’s still seeing robust demand from builders and remodelers. Over the short term, what’s happening at the banks isn’t a big problem for construction supply. But when you think longer-term—as LBM buyers must do—those woes could add a potentially troubling variable to buyers’ calculations. Ultimately, it’s in the construction supply industry’s interests to have a vibrant regional and small banking sector, and simultaneously be able to show buyers they can do well even if those banks continue to be challenged.

Small and regional banks—i.e., all banks ranked 26th and lower in size nationally—provide two-thirds of all commercial real estate loans and more than one-third of all residential real estate loans, Axios reports, citing Federal Reserve figures. Smaller banks are the institutions that pride themselves on making loans based on relationships and giving start-ups a chance.

While lots of dealers rely on banks primarily to store and process cash and perhaps provide a line of credit, builders—especially custom builders and small regionals—depend more heavily on banks to buy land and launch construction projects. Small and regional banks have been more likely than their big cousins to take a chance on such initiatives.

Indeed, even as the Federal Reserve has been raising interest rates, the Fed’s latest survey of banks’ senior loan officers found small and regional banks were five to eight percentage points more likely than big banks to leave unchanged their credit standards for construction and land development loans. And, as the Federal Reserve pushed up the cost of borrowing, small/regional banks reported less of a drop in demand for commercial and industrial loans than did the big banks.

Federal regulators and members of Congress appreciate what small and regional banks do for Main Street, but that doesn’t mean they are going to let this mini-crisis pass without a review. The FDIC’s current $250,000 guarantee on bank deposits is certain to come up for discussion, particularly given fears that the Silicon Valley Bank and Signature Bank failures might have left the impression that ALL deposits will be protected from now on. (Over 90% of Silicon Valley Bank’s accounts had more than $250,000, Reuters reported.)

According to Roll Call, a publication that tracks what’s happening in Congress, lawmakers on both sides of the aisle worried that an implicit guarantee of all deposits would remove a sense of risk in banking that all big depositors should feel. But then Roll Call added: “Others feared customers at small and midsize banks would hear the opposite message and move their money to the two or three biggest banks considered ‘too big to fail.’”

What’s next? Even with existing laws, examiners of small and regional banks could toughen their loan reviews, and that is in addition to whatever bank loan officers will do voluntarily. Indeed, Goldman Sachs predicts a tightening of lending standards that will cut our annual GDP growth rate to 1.2% from Goldman Sachs’ previous forecast of 1.5%.

The federal government also could give the option of guaranteeing all deposits and impose additional insurance fees on the amount over $250,000. Or, it could simply raise the $250,000 cap everywhere and increase banks’ FDIC insurance payments accordingly. And of course, while all this is being discussed, the Fed still is fighting inflation via high lending rates.

Whatever happens, small and regional banks are likely to find it a bit tougher to do business and give loans than they did before Silicon Valley Bank collapsed. That ultimately will increase the headwinds that builders already face in planning construction projects for late this year and beyond. The distant thunder dealers hear now could get closer as the months pass.

Greenfield Openings, Expansion Plans, Deals Show LBM Investment Remains Robust

Current numbers and future plans suggest construction supply dealers and investors have remained active so far in 2023, despite concerns about lending rates and a potential slowdown in new-home construction.

At 95, the number of facilities acquired through late March is close behind the 103 facilities that changed hands by the same time last year. The number of greenfield openings–39–is just one behind last year’s pace, and there are at least 40 other facilities scheduled to open later this year.

Of those numbers, nine of the facilities acquired and 27 of the openings involved either lumberyards or truss manufacturing plants. Another 46 locations are part of US LBM’s sale of its drywall specialty stores to L&W Supply, the gypsum division of ABC Supply.

The facilities bought so far this year came in 20 deals involving 19 buyers. Among the latest deals:

* Colony Hardware acquired New South Construction Supply, a metal and concrete specialty supplier with 13 branches.

* SiteOne Landscape Supply bought J&J Materials, a landscaping specialist with three branches in Massachusetts and two in Rhode Island.

* Cook County (MN) Home Center acquired Sawtooth Lumber of Grand Marais, MN.

* SRS Distribution bought Exteriors Inc. of Bowling Green, KY.

* ABC Supply purchased Thermal Tech Inc. of Kalispell, MT.

* Jason Minteer, the longtime manager and VP of Carpinteria (CA) Valley Lumber, became a new co-owner and set about revamping the facility.

Recent openings included a Beacon branch in West Bend, WI, and Stone Center of Texas (an SRS Distribution division) in Frisco, TX.

Remodeling’s Near- and Short-Term Futures Differ, Two Reports Suggest…

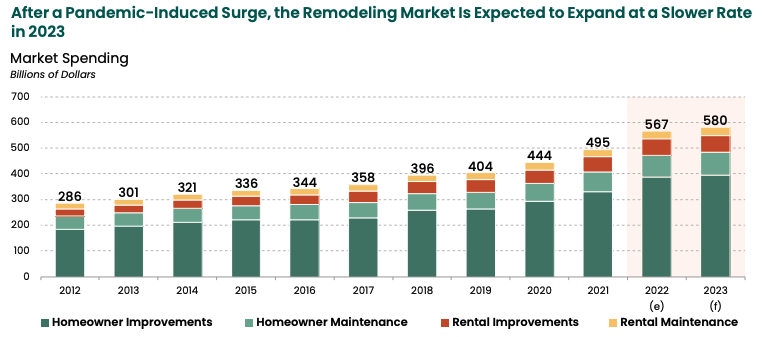

Expect spending on remodeling this year to barely rise above last year’s level, according to a new report from Harvard’s Joint Center for Housing Studies (JCHS). But another research group forecasts that, longer term, you can expect boom times.

“After several years of double-digit gains, the pandemic boom in home improvement and repair is expected to slow in 2023 from its breakneck pace,” JCHS said in its annual report, Improving America’s Housing, released March 23. “The residential remodeling market faces many headwinds that may worsen over the near term, including high inflation, rising interest rates, slowing house price appreciation, and declining home sales. With uncertainty in the housing and labor markets, homeowners may scale back or defer high-cost discretionary projects, such as major kitchen and bath remodels and room additions.”

The 2.2% gain forecast for 2023 looks especially weak because of how much spending on remodel work has swelled in recent years; It grew 10% in 2020, 11% in 2021, and 15% in 2022. Surveys by The Farnsworth Group have noted a slowdown is under way. When asked to rate how busy they were on a scale of 1 to 10, remodelers polled by Farnsworth gave a score of 6.8. First-quarter responses often trail over other periods in this survey, but it’s notable that just six months earlier the score was 7.6.

To Matt Saunders and Chris Porter of John Burns Real Estate Consulting (JBREC) challenges now definitely will be followed by great times ahead. Saunders is JBREC’s SVP for Building Products, while Porter is the Chief Demographer.

The two point to several factors that will propel a long-term remodeling boom. In particular, the number of homes in their “prime remodeling years”–i.e. 20 to 39 years after they were built, will rise by 20% to more than 24 million, they said. These often are the years in which houses will get a new roof, windows, and doors, or updated kitchens and baths, they said.

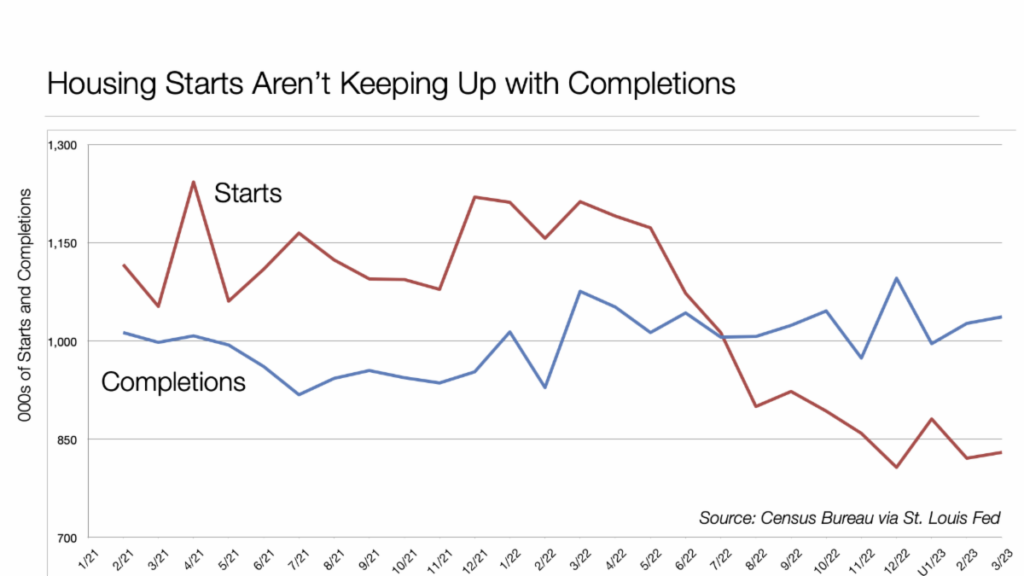

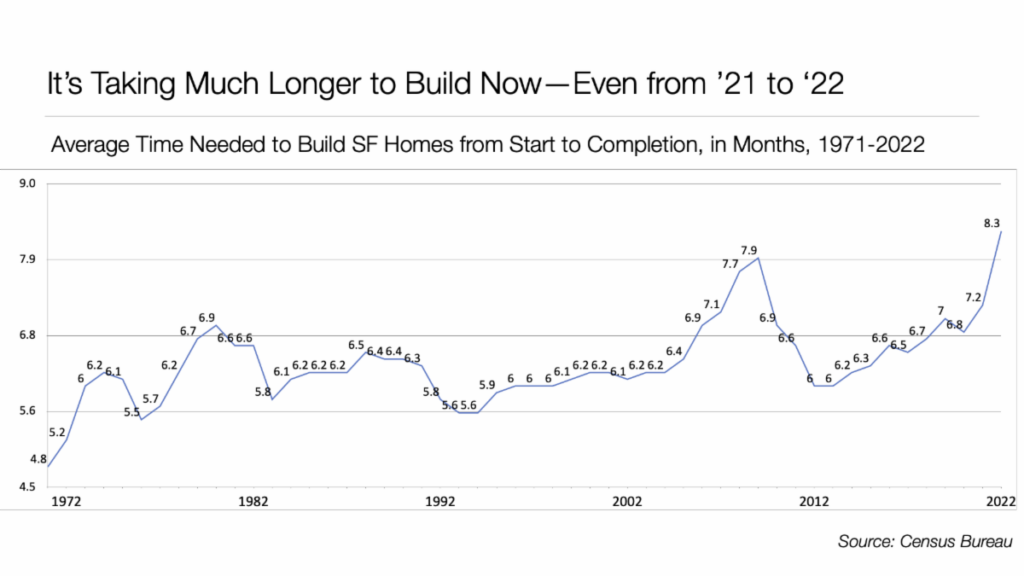

…While New-Home Construction Is Having Its Own Diverse Near- and Short-Term Issues

Two recently released reports that were turned into the charts above can help explain why lots of LBM dealers will tell you how busy they are even as homebuilders and industry observers fret. In essence, building material dealers are occupied because they still are working through the construction projects they have taken on over the past year. For them, it’s still full speed ahead, particularly because it took an average of 8.3 months to complete a single-family house 2022, up one month from 2021 and nearly double the time required 50 years ago.

Meanwhile, builders are starting much fewer homes. The starts rate has been declining since last July, with the first big drop last August. Given that 8.3 month completion-time average, the completion numbers should start dropping significantly by May. As we near that point, dealers will notice the change.

That said, keep in mind that the first chart covers all single-family housing. Custom homes–the subset of the housing industry that provides much of the average dealer’s business–appears to be having its own slowdown, but the drop might not be as steep. A total of 203,000 custom homes were started in calendar year 2022. That’s 4% more than in 2021. The 12-month increase through 3Q22 had been 10%, but 2022’s 4Q was 10% lower than in 2021.

In addition, multifamily housing permits are up in most markets. Some dealers will be able to shift their selling to that market. And, as said above, remodeling will hold steady.

Check Out EquiNova’s Updated Website

You’re invited to visit our newly updated website, equinovacapital.com, and get a better sense of how we provide M&A advisory services and private equity capital to middle-market companies. The site has sections introducing you to our team, details on the services we provide, and a list of transactions we’ve done.