By Michael Collins, Managing Director, EquiNova

July 2022

Before getting into the numerous, sometimes contradictory indicators on the building materials market that have come out recently, I need to ask a question: Do you have grandchildren?

Washington Post columnist Hugh Hewitt posed that question–which he remembers being asked of him years ago by Mitt Romney–as prelude to a recent commentary on who could become Britain’s next prime minister. The question is appropriate here, too, for reasons Hewitt explains:

“Your view of events shifts fundamentally when grandkids enter the picture. You think longer term. The politics and the personalities of the day are less important than ensuring the right choices are someday placed before those who might decide the important things.”

Given the scary talk we’re hearing from builders and the building press, it’s easy to lose that longer-term perspective and focus instead on the latest fears. Dealing with the current buzz can cause you to suspend or even abandon long-term strategies, forcing you to expend extra effort to restart your initiative once conditions improve–assuming you ever get back to them.

I’m not suggesting here that you ignore the economy’s warning signs, because they figure into your current tactics. But I am suggesting that you operate in a way that keeps propelling you toward your goal: A business that’s solid and successful from now until your grandchildren are adults.

In these times, keeping perspective is particularly important. News reports are full of headlines about abrupt drops in demand for mortgages and how builders are cutting prices. Many of those actions are so dramatic because they follow dramatic times. In essence, we’re resetting expectations after living through selling and supply chain conditions that just about everyone agrees weren’t permanent. It’s the snapback that’s the problem, not the fundamentals. “Indeed, while the current buyer’s strike is severe, it appears to be tied as much to negative psychology as actual unaffordability,” Evercore ISI wrote in a July 20 commentary.

Evercore believes the housing market’s real driver is a longer-term issue–demand. We have too few homes for the population in general, and especially too few homes in places where people want to live. That demand is likely to be robust for years.

Over time, what really matters in your market are the components that drive demand: Numbers like population growth, changes in income, the household formation rate, the age profile, employment growth, and access to land. Those are many of the real market conditions that should figure into your long-term strategies. The rest of the news is tactical information. Those headlines will help you win today’s battles, but they won’t assure you’ll win the war. Your grandchildren are counting on you to make the right choices.

We May Not Go Over the Edge, but the Latest Housing News Suggests Challenges Lie Ahead

Here’s a roundup of the latest news affecting construction supply dealers:

* The number of single-family housing permits through the first five months of 2022 is 2% lower than this same point in 2021, totaling 473,997. Twelve states have seen growth. The top five markets for single-family permit were Houston, Dallas-Fort Worth, Phoenix, Atlanta, and Austin.

* Existing home sales in June fell 5.4% from May and 14.2% from a year earlier to reach a seasonally adjusted annual rate of 5.12 million. Year-over-year sales have been down for 10 consecutive months.

* The median price paid in June for an existing home was $416,000. That’s a 13.4% increase from June 2021 and the 124th consecutive month of year-over-year increases.

* Softwood lumber prices may be 23% lower, but the prices of all goods used in residential construction climbed 1.5% in June from May, according to the latest Producer Price Index.

* Spending on kitchens and baths is expected to rise 16% in 2021 to hit $189 billion, the National Kitchen & Bath Association says in its midyear outlook. New construction figures in 60% of the $189 billion. This year’s initial outlook was $10 billion higher. “We anticipate moderate declines in kitchen and bath spending in the event of a recession next year,” NKBA CEO Bill Darcy said in a news release.

* Spending on homeowner improvements and repairs will grow more slowly n 2023, predicts the Joint Center for Housing Studies (JCHS) of Harvard University. Its Leading Indicator of Remodeling Activity (LIRA) forecasts remodeling spending will rise 17.4% this year to $431 billion. But then the total for the four quarters ending in March 2023 slows to a 14.9% increase, to $448 billion, and for the four quarters ending June 2023 there’s only a 10.1% increase to $446 billion.

* Applications for mortgages dropped 7% for the week and were 19% lower than the same week last year, the Mortgage Bankers Association says. Overall demand is at its lowest level since 2000.

* The share of “cost-burdened renters”–people who have to spend more than 30% of their incomes on rental and utilities each month–rose to 46% in 2020, up 2.6 percentage points from the year before. This is according to a JCHS analysis of Census Bureau data.

Three Ways US LBM’s Foxworth-Galbraith Deal Matters for Construction Supply M&A

By Craig Webb, President, Webb Analytics

A month ago, I wrote here that, “If LBM’s Mergers and Acquisitions market were a baseball game, you could say this season is featuring a lot of singles and doubles compared with last year’s home runs and grand slams.” Little did I know then that US LBM was about to step to the plate.

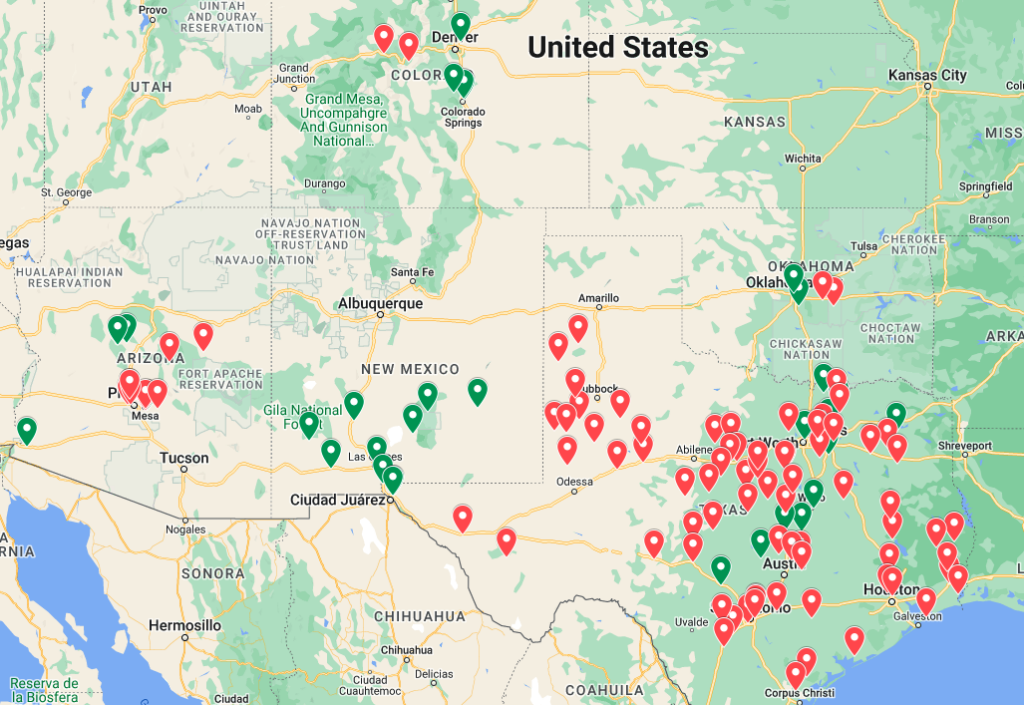

US LBM’s acquisition of Foxworth-Galbraith Lumber easily ranks as the biggest deal in construction supply so far in 2022. The $925 million in sales FoxGal recorded last year increases US LBM’s total revenues by 10%; it had $9.22 billion in sales in 2021. The deal also increases by one-third, to 111, the number of US LBM locations in five Southwestern states. Builders FirstSource remains the biggest lumberyard operation, with $19.9 billion in sales last year–a figure that excludes the $450 million in revenues it picked up in January by acquiring New England-based National Lumber.

What lessons can we draw from the FoxGal deal? I see three:

1. The Game Isn’t Over. There has been talk that M&A activity would have to slow this year because interest rates would go up and new-home sales would go down. But the pace of transactions has remained fairly steady: So far in 2022, Webb Analytics counts 67 acquisitions in construction supply vs. 70 deals by this point in 2021. What has changed is the number of locations involved–205 this year vs. 350 last year–as well as the perception that big fish weren’t being hooked. Until now, that is: FoxGal’s status as the No. 25 company on the Webb Analytics Construction Supply 150, plus National Lumber’s $450 million in 2021 sales (which would have ranked it 34th) would qualify as big fish in any year. Clearly, there’s still an urge to merge.

2. An Opportunity for Pricing Power. The 59 lumberyards with manufacturing capabilities on the Construction Supply 150 reported $55.27 billion in revenue last year. BFS and US LBM accounted for 53% of that total, and if you add in the money from FoxGal and National Lumber, their share rises to 56%. In addition, both have invested deeply in making value-added products like trusses, panels, windows, and millwork while decreasing their reliance on sales of commodities.

As a result, BFS and US LBM may be getting closer to achieving the kind of pricing power that other industries have achieved. Economists say it usually takes a combination of market share and high-demand products to wield pricing power. These two giants aren’t there yet, but every big deal brings them closer.

3. All Markets Matter. Glance over the recent purchases by US LBM and BFS and their strategies become clear. Both companies want to be big players in Texas and Arizona. Both are spending heavily on truss specialists and dealers with lots of fabrication plants. Both are opportunistic when an opportunity arrives to widen geographically (such as US LBM’s purchase of the Meek’s yards in Missouri and California) or financially (such as BFS’ purchase of yards better known for remodeling than for new-home sales).

But when you look beyond those two buyers, all sorts of tactical moves are in play. TAL Holdings is working geographically, buying small, community-centric yards in Washington State, Oregon, and Idaho. In contrast, Kodiak Building Partners was looking to support several of its far-flung operations when it purchased a custom door maker with stores in seven states. Strategy also was in play when McCoy’s Building Supply sold three stores in Mississippi and one in Arkansas to a branch of Central Network Retail Group. McCoy’s Texas-based distribution network strained to reach those stores, but for CNRG the facilities were in the heart of their Home Hardware Center chain.

The point here is that virtually every LBM operation has qualities that could make it a good acquisition–or a good acquirer. As a result, it’s unlikely we’ll see any significant slowdown in M&A in the year ahead.

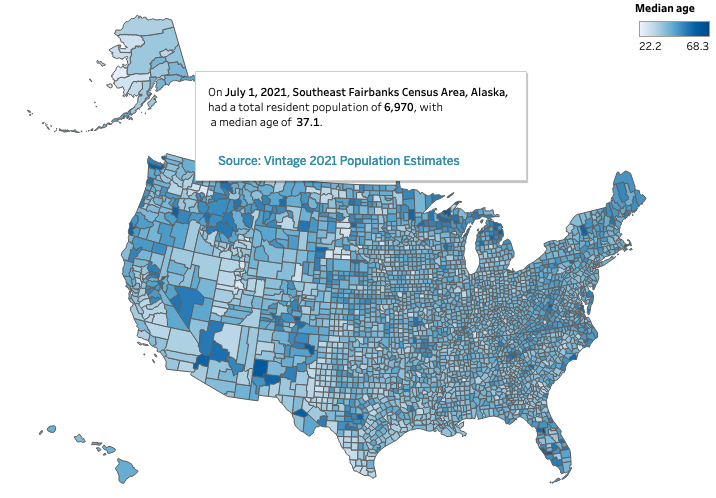

New Census Bureau Service Helps You Identify Age Differences in Markets of Interest

General population numbers–even as seemingly specific as the median age of residents in a county–can hide differences that can be important when you’re researching a market. For instance, Orange County and Santa Cruz County in California both have a median age of 39.1, meaning half the population in each county is older than 39.1 years and half is younger. But in Orange County, the large segment of the population is in ages 30 to 34, making them good candidates for single-family homes. Meanwhile, in Santa Cruz County, the largest share is aged 20 to 24–an age group more likely to want apartments.

These nuances are easy to spot in a new Census Bureau visualization tool announced July 19. They’re helpful even if you do more general research. For instance, the Census Bureau notes, the median age in Florida in 2021 was 42.7 years, but inside the Sunshine State the median ranges from 32.1 in Leon County to 68.3 in Sumter County.

The visualization tool also shows the percentage of county residents based on race and Hispanic origin.

Watch My Webinar with Key Buyers, Sellers

Here’s a reminder that you can watch my webinar with several former LBM company owners who have sold their businesses over the past several years. Joining me were Jeff Smith, CFO at Kodiak Building Partners (pictured second from left above); Jim Hooper, SVP of M&A at US LBM (second from right); Jon Vaughan, a regional VP at US LBM whose family business, Brand Vaughan Lumber, was acquired by US LBM last July (far right); plus Jerry Jehn of Builders’ Millwork and Tony Shepley of Shepley Wood Products (not pictured). Those two companies were acquired by Kodiak. The webinar was taped June 14. The event was sponsored by Buildxact.