The nation’s busiest state for home building saw the biggest deal since mid-September when US LBM acquired Texas Tool Traders, a tool specialist with 15 locations across the Lone Star State. In addition, Nation’s Best Holdings bought the three-unit South Texas Hardware, and McCoy’s Building Supply revealed it’s closing stores in Kingsville and Orange.

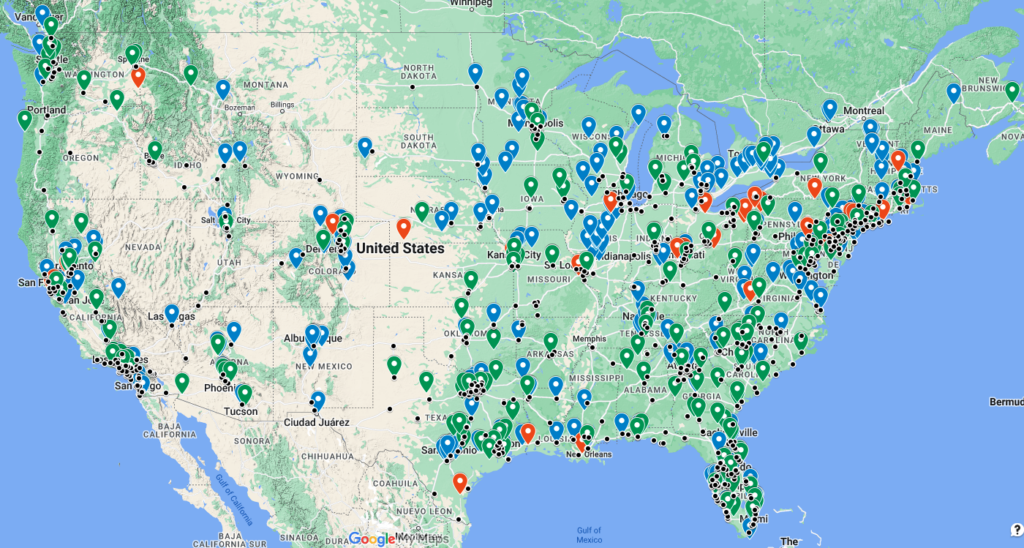

So far this year, Webb Analytics has identified 1,072 construction supply facilities that have changed hands–769 when The Home Depot bought SRS Distribution and 303 that were part of 60 other deals. There also have been 196 store openings that have taken place or are set to occur in 2024, plus 37 announced store closures. The 1,305 total actions make this the busiest year in LBM since at least 2018.

In other recent actions:

* Builders FirstSource acquired Douglas Lumber of Smithfield, RI, and High Mountain Door & Trim of Reno, NV.

* Aside from the Texas Tools deal, US LBM also purchased Milton (FL) Truss.

* Structural Building Solutions acquired N Z Cramer & Sons of Woodsboro, MD.

* Richards Building Supply bought Fond du Lac (WI) Distributors.

* Hancock Lumber bought Tiny Homes of Maine.

* Dufrene Building Materials announced it was expanding to Pensacola, FL.

* Copeland Do it Best Lumber set up shop in Lincoln City, OR.

* Ring’s End Lumber opened a Johnson Paint branch in Plymouth, MA.

* Beacon opened new stores in Pelham, AL; Mesa, AZ; and Bellingham, WA.

* ABC Supply opened stores in Chicago and in Sheboygan Falls and Hudson, WI.

* Decks & Docks opened in Port Orange, FL

* Outdoor Living Supply added four locations in two deals: Garden Supply Hardscapesof San Jose and San Carlos, CA; and (in one deal) Mid-Atlantic Concrete of Winston-Salem, NC, and South Atlantic Concrete of Cumming, GA.

* Moscow & Pullman Building Supply’s branch in Pullman, WA, will close in November.

* Floor & Decor opened stores in Austell, GA; Kansas City, MO; Turnersville, NJ; Owings Mills, MD; and Davie, FL