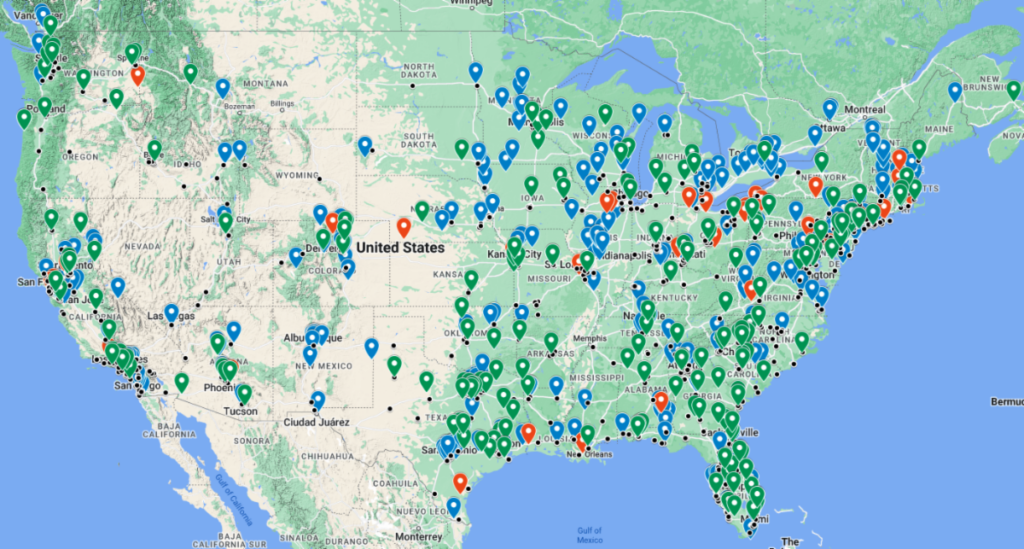

Construction supply facilities acquired (blue pins), that had or will have greenfield openings (green), or that closed (red) YTD in 2024. Black dots show SRS Distribution locations acquired by The Home Depot. Not shown: Five acquisitions and one store opening in Hawaii. Source: Webb Analytics

By Craig Webb, President, Webb Analytics

We enter the final two weeks of the year with 147 deals recorded in the Webb Analytics database, three more than in all of 2023. And the 1,098 facilities acquired not only doubles 2023’s count, it’s also the biggest number for any year since at least 2016.

On the other hand, the 72 buyers so far in 2024 is the lowest since 2020, and the 147 purchase transactions falls markedly below the 179 in 2022 and 182 in 2021. It appears that two years of Fed rate hikes depressed this year’s activity. That’s one reason why the Fed’s recent easing has led to expectations that we’ll see more deals happen in 2025.

This year’s deals map is dominated by one purchase: The Home Depot’s buyout of SRS Distribution and its 769 branches. Take away that one and you have 146 transactions nabbing 329 facilities–a dramatic decline from the 483 locations purchased in 2023.

There also have been 214 greenfield locations that have or were expected to open this year, down from 247 last year. The number of closures now stands at 45 vs. 57 in all 2023, but it often takes much longer to get word of closures than it does to learn of purchases or openings.

In recent activity:

- McCoy’s Building Supply purchased its first components plant, buying Rio Trussof McAllen, TX.

- Gazaway Lumber took over City Lumber of Fayetteville, AR.

- Contract Lumber bought Cedar Supply, which has branches in Carrollton, Kyle, and Sherman, TX.

- 84 Lumber opened a new yard in Greeley, CO.

- Dealers Choice, the distribution arm of Beacon Building Products, bought Fairway Wholesale of South Hadley, MA.

- ABC Supply’s gypsum specialist, L&W Supply, opened in Athens, GA.