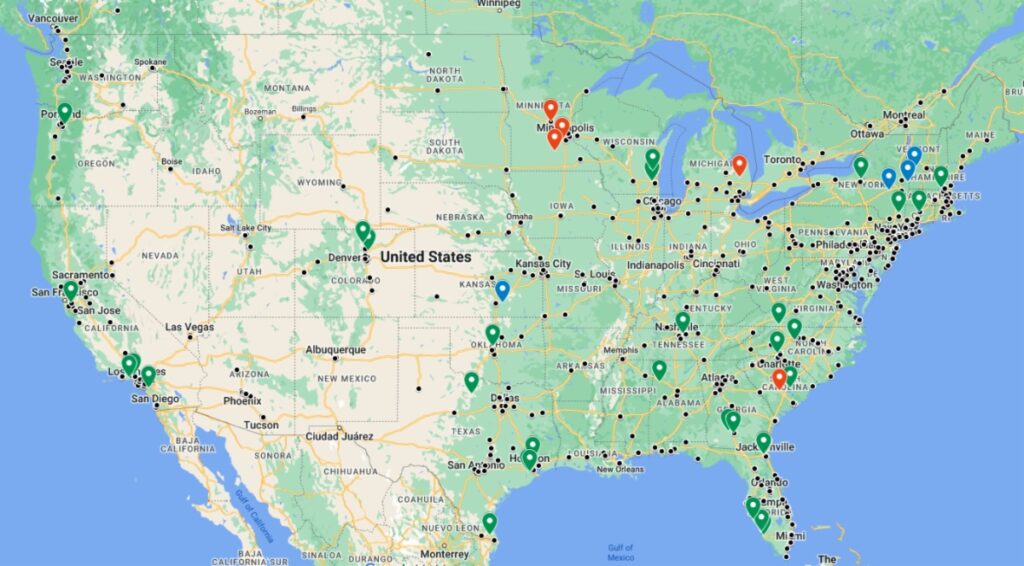

| By Craig Webb, President, Webb Analytics As Webb Analytics prepares to release at month’s end its annual report on 2024’s LBM acquisitions, openings and closures, here’s a look at what has happened or will happen so far in 2025. We only have two acquisitions in the books–they have the blue pins above. One involves Aubuchon Ace Hardware’s purchase of three Noble Ace Hardware locations in Vermont and New York, and the other is Westlake Ace Hardware’s acquisition of Augusta (KS) Ace Home Center. The biggest merger news to emerge in January hasn’t been completed and perhaps never will–at least the way QXO hopes it will. On Jan. 15, QXO announced it had been trying for months to buy Beacon Building Products (marked with black dots on the map above) for roughly $11 billion. Beacon rejected the offer, saying QXO’s offer “significantly undervalues” the company. Beacon’s rejection announcement also noted that QXO has never increased its bid–a possible suggestion that Beacon would be open to selling if it could get a higher price. Indeed, QXO said Beacon told it in early December that it was contacting other potential buyers. Who might strike a deal? The list of suspected suitors includes Lowe’s and Builders FirstSource. Or perhaps QXO will increase its bid. As for greenfield openings, the map above shows 34 green pins, only two of which are known to have happened so far in 2025. Among the planned openings are a consolidation project in Jacksonville, FL, where Builders FirstSource will close two facilities and move them into a big new space. In addition, 84 Lumber says it will open truss plants in South Carolina and Colorado and a components facility in New Hampshire. Erie Materials is opening a facility in New York and Drexel is doing the same in Wisconsin. Other plans involve McCoy’s Building Supply, Matt’s Building Materials, Parr Lumber, Short & Paulk, Three Bears Alaska, and a slew of Ace Hardware stores. In fact, half the 34 greenfield openings planned involve Ace dealers. |