Our colleague at Webb Analytics has counted 143 acquisition transactions so far this year, just one deal short of what we saw in all of 2023. Sixty-nine buyers have done this year’s acquisitions, taking over 1,093 facilities. Last year, about 5% of all actions took place in the final six weeks, so odds are quite high the 2024 deals count will finish above 2023’s.

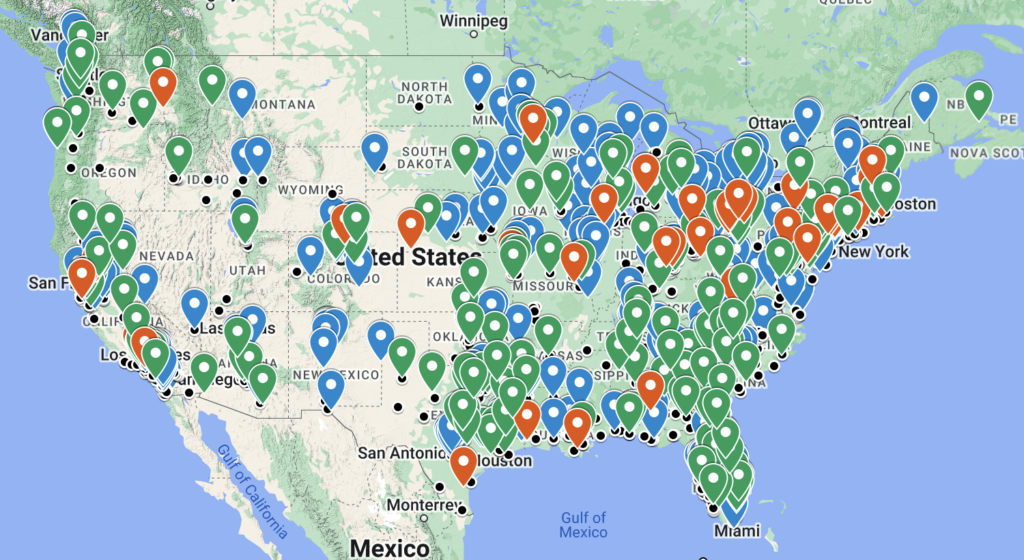

Last year, 86 buyers purchased 483 facilities. This year’s count is twice as large despite having fewer buyers because of one megadeal: The Home Depot’s takeover of SRS Distribution’s 779 branches (shown with black dots on the map above). The other 142 deals this year involved 324 facilities (blue pins above). Excluding The Home Depot-SRS deal, the number of facilities purchased per transaction works out to 2.3 yards per deal this year vs. 3.4 yards per deal in 2023. There also have been 203 locations that have opened or were slated to open this year (green pins), plus 41 store closures (red pins).

The biggest deal since mid-October saw Carter Lumber, which hasn’t been active in the M&A market for close to a year, buy Townsend Building Supply. Townsend is a six-store operation serving South Alabama and the Florida Panhandle.

In other recent actions:

* Kansas-based Star Lumber purchased Apex Lumber of Edmond and Tulsa, OK.

* Beacon Building Products’ subsidiary, Dealers Choice, bought Fairway Wholesale Distribution of South Hadley, MA.

* Nation’s Best Holdings added Burns Hardware of Clovis, NM.

* Zuern Building Products took over Wood Specialties Inc. of Menomonee Falls, WI.

* R.P. Lumber bought Perryville, MO-based Guyot Lumber.

* Decks & Docks expanded to Houston by acquiring Bayou Lumber.

* Aubuchon Hardware bought Anco Ace Hardware of Villas, NJ.

* Ring’s End Lumber took in A&M Paint and Wallpaper of Portsmouth, NH, and will make it part of its Johnson Paint division.

* Hartville Hardware acquired Coshocton (OH) Lumber.

* Arizona-based United Southwest Components opened a truss plant in Alvorado, TX.

* McCoy’s Building Supply closed stores in Kingville and Orange, TX. Other closures were at Moscow & Pullman Building Supply in Pullman, WA, and Fulton Lumber and Coal in Wauseon, OH.