By Michael Collins, Managing Principal, EquiNova

A few weeks ago, I had the honor of addressing some of the most powerful executives in construction supply when I spoke at the LBM CEO Summit. The speech distilled decades of experience doing M&A transactions into eight ways that LBM dealers can improve the value of their business. I recommend you study these suggestions regardless of your future plans. Increasing your value puts you in better shape to buy other companies, generate higher revenues and profits from existing operations, or command a higher price when sold.

Here’s a summary of what I recommended.

Compare Your Compensation Levels with Market Norms

You might be proud of how you have reduced costs by paying below-market rates, but that tactic can lead eventually to higher-than-average turnover, unmotivated team members, and trouble attracting talented managers. And, if you’re trying to sell a company that pays below the norm, the buyers could discount what they’ll pay you because they assume they’ll need to boost the payroll.

On the other hand, if you pay wages way above the norm (such as we’ve seen happen with salaries of close relatives of the owner), potential buyers who believe in paying the going rate might walk away from the deal because they don’t want to get a reputation for cutting wages.

What to do? If you’re below market, pay more and let lower turnover and higher motivation offset the compensation cost. And if you’re currently above market, move to a system that pays performance-based bonuses atop an industry-standard base salary.

Adopt Finance Best Practices

Invest in a quality accounting system that gives you more visibility into your operations, such as revealing gross margins at the product level. Then share P&L visibility and responsibility among senior managers—especially the people who would lead the company after the owner leaves. One such manager might be a chief financial officer. If you don’t have one, consider hiring such a person, even if that person is employed only on a fractional basis. A CFO usually can improve operations beyond what a controller can, and thus help you grow to the next level.

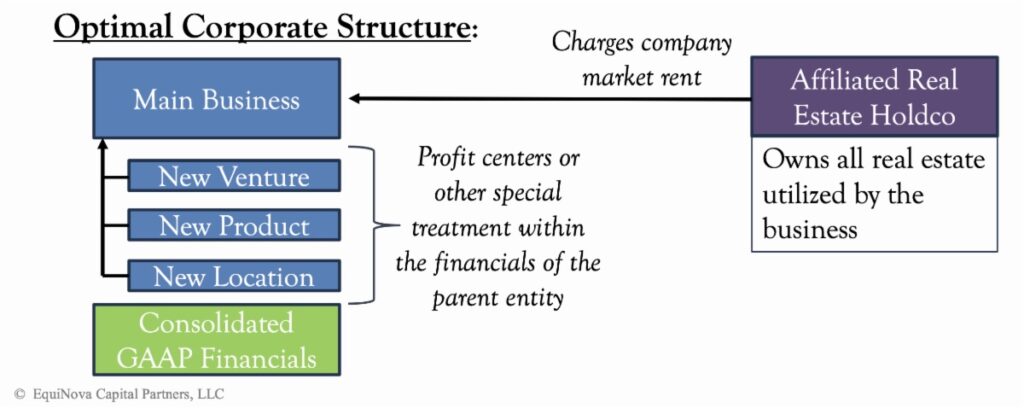

Sometimes we’ve seen companies create separate entities when expanding geographically or when branching into new business or product areas. Theoretically, this can isolate the losses of a new venture from the profitability of the parent company. This can be tempting, since it keeps the new venture from affecting profit-sharing bonuses of the management team. Such an impact might discourage managers from pursuing new ventures if they had a short-term impact on their bonuses. Creating such separate entities, though, makes a company more complicated and difficult for outside investors to assess.

We prefer this corporate setup:

Fill Your Management Bench

Investors like to see an organization chart with one person managing a particularly vital task, be it finance, operations, purchasing or sales. Empty slots on the org chart, or multiple positions occupied by one person, can be a signal that a vital task isn’t getting the attention it deserves.

Beware, as well, of managers who tell the owner that they will work as long as the owner does. This means that if a sale occurs, the buyer will have two key positions to fill. Instead, owners should transfer that manager’s duties to someone else in advance of the owner leaving.

Also, make the future foreseeable by making sure each second-tier manager explicitly knows they are the heir apparent to the senior position above them. If not, those second-tier managers begin to fret about being passed over, and thus are more likely to jump at an offer from a competitor.

Take the “Telephone Test”

Here’s a time-tested way of determining whether the owner of a company has successfully transitioned their duties to the next level of management. Imagine the company gets a telephone call from a new customer who wants to explore buying from the company. Who answers that call? If an existing customer calls with a problem, who answers the phone? If a key supplier calls with an issue, who takes the call? If the answer to those questions is “the owner,” then there’s a problem brewing for the buyer once the current owner leaves.

Evolve Your Sales/Marketing Structure

Here’s my outline for how to grow:

Improve Your Inventory Practices

Ideally, your company should operate on a continuous inventory model, as that increases your odds of making a profit and improves your operating efficiency. Your goal should be to make small or no adjustments to your book inventory amounts. There’s plenty of new technology, particularly involving scanners, that can help you count faster and more accurately than ever, and doing the counts you need in less time. You also benefit from improved morale, as doing inventory rivals changing price tags for the title of LBM’s most disliked chore.

When Selling, Remember What You May Have Promised

Be very careful regarding past agreements granting anyone the right of first refusal or right of first offer on your business. Senior managers sometimes request this early in a company’s life, and then when the opportunity arises they seldom have the ability to acquire the company. We’ve seen owners pay meaningful amounts for managers to rescind such rights.

Unwritten promises can be just as dangerous. One of the most common is when the owner tells a manager “When I sell, I’ll take care of you …” Rarely do you find bigger language disputes than you do with debates over what “take care” means. Get these agreements in writing.

Everyone Should Conduct a Lien Search

Do this at least every couple of years. Whenever a business seeks outside capital from providers such as banks or equity investors, those providers will want to be aware of any lien holders who have a valid claim on the LBM company’s assets. Virtually every search we have ever seen contains on or more unexpected or outdoor liens against the business. Usually they were satisfied long ago, but remain on the books. Removing them can be time consuming, so you want to clear the decks before you go out seeking capital.

Those, in a nutshell, were my eight suggestions. They aren’t always easy to achieve. But, if you work steadily to accomplish them, you’ll end up with a better company.