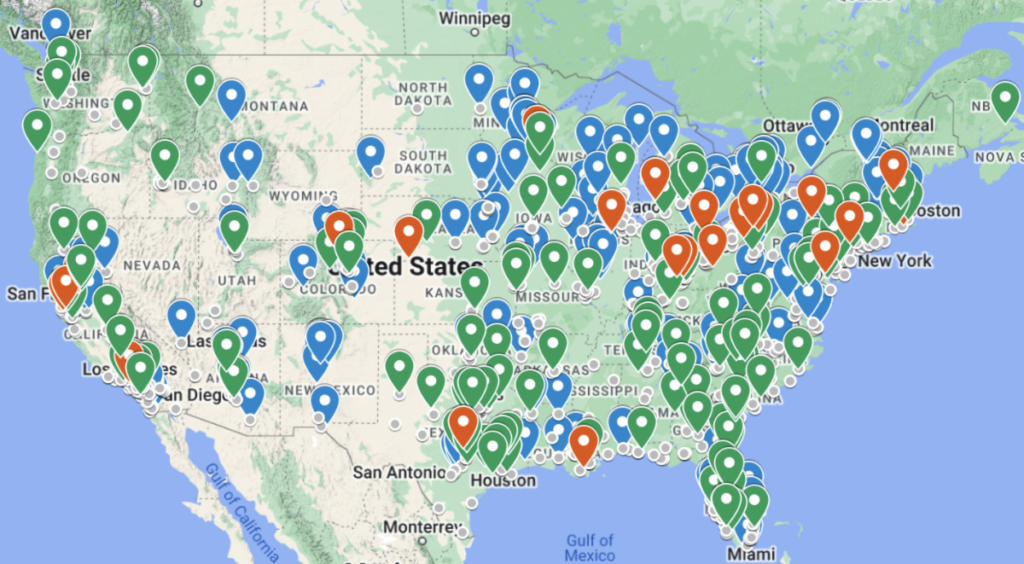

Construction supply facilities acquired (blue pins), were newly opened (green), or closed (red) YTD 2024, plus locations of SRS Distribution facilities (gray dots) acquired by The Home Depot. Source: Webb Analytics

Between January 2020 and July 2024, a total of 178 truss and components facilities have changed hands or opened anew. Of those, 13 were purchased and three opened in just the first half of this year, Webb Analytics’ database shows.

Thirty-eight companies have figured in these openings and purchases, but Builders FirstSource by itself figures in one-third of the activity. Its 56 acquisitions and openings far outpace No. 2 US LBM’s 38 actions and is way ahead of 84 Lumber’s 16 moves and Parr Lumber’s eight After that comes Kodiak Building Partners, with six acquisitions. No other company had more than five, and several took over or opened just one location.

Truss and component facilities have been targets for LBM dealers throughout this decade. There were 34 acquisitions and openings in 2020–excluding the plants BFS picked up when it absorbed BMC–followed by 57 actions in 2021, 41 in 2022, and 30 in 2023.

So far this year, a total of 986 facilities of all type have been acquired, 769 of them in The Home Depot-SRS deal. There also have been 149 actual or planned greenfield openings, plus 26 actual or soon-to-occur closures..

Among recent actions:

- Builders FirstSource strengthened its presence in California’s Orange County by buying CRi SoCal, a door and window showroom in Irvine. BFS also beefed up operations north of Phoenix by acquiring Western Truss, situated in both Flagstaff and Prescott Valley, AZ.

- US LBM took over another truss manufacturer, this time Automated Products Inc. of Marshfield, WI.

- Beacon Building Products picked up four Florida-based metal roofing manufacturer locations in one day: Integrity Metals of Vero Beach and Gainesville and Extreme Metal Fabricators of Palm City and Key Largo. Then, later in July, Beacon acquired Walnut, CA-based Roofers Mart of Southern California.

- Gleckler & Sons Building Supplies bought L.L.T.’s Building Supplies of Tampa, FL.

- Kodiak Building Partners bought Thomas Building Center of Sequim, WA.

- Timberline Enterprises took over Hanson, MA’s Northeast Building Supply.

- Nation’s Best Holdings bought Big Bear Hardware of La Vernia, TX.

- Contract Lumber opened a new location in Hillsboro, AL.

- SRS Distribution hasn’t stood still since it was acquired by The Home Depot. Since June 22, SRS has opened American Roofing Supply stores in Prescott, AZ, and Castle Rock, CO, and an SRS Building Products outlet in Eagan, MN.

- Foundation Building Materials bought Sovereign Supply, located in Phoenix.

- Zuern Building Products acquired Saeman Lumber of Cross Plains, WI.

- SiteOne Landscape Supply acquired Mlican Nurseries of Chichester, NH.

- ABC Supply’s Town and Country Industries acquired Aluminum Products Wholesale of Mobile, AL.

- Elder’s Ace Hardware grew again by taking over Farley’s Ace Hardware in Dunlap, TN.

- America’s Floor Source opened a huge showroom in Columbus, OH.

- Gilllman Home Center expanded in Indiana by purchasing Goecker Building Supply, which has operations in Seymour and North Vernon.