By Michael Collins, Managing Principal, EquiNova

June 2023

One of my favorite scenes in the original Jurassic Park movie came when a jeep’s driver and passengers were being chased by a Tyrannosaurus Rex. The driver glanced at his rear-view mirror. “OBJECTS IN MIRROR ARE CLOSER THAN THEY APPEAR,” lettering on the mirror declared, just below the toothsome close-up of a T. Rex eager to turn the jeep’s occupants into its next meal.

I have been thinking of that scene because of all the talk recently about when building material dealers are going to get hit by the oft-predicted economic recession. Like the dinosaur in that mirror, our object of concern sure looks threatening, but I believe it’s further away than appearances suggest. Odds are improving that dealers will escape its clutches.

I say this even though the threat appears to be getting closer. Builders FirstSource (BFS) reported its first-quarter sales dropped 31.6% from the year-earlier quarter, while net profit shrank 48%. BlueLinx did even worse, with sales falling 34% and net profit plunging 86%. The annual housing starts rate in April was 22.3% below its year-earlier number, and remodeling expenditures in the four quarters through spring 2024 are forecast to decline. A negative remodeling number is something we haven’t seen in years.

But all these indicators and all the warnings from big-time economists need to be put into context. The BFS and BlueLinx numbers look particularly bad because lumber prices were 46% higher in the first quarter of last year than they were in January through March of this year. Future quarters probably won’t look as bad simply because the differences in commodity prices won’t be as stark.

Meanwhile, dealers remain busy providing materials for a near-record level of homes under construction. BFS’ CEO told analysts of the resilience he’s seeing among home builders, citing what he described as “green shoots” in future construction plans.

As for repair and remodeling, while there are indications that the spend is dropping, high-end remodelers most likely to do business with a pro dealer say they are just as busy as ever, albeit with fewer leads. Wealthy Americans haven’t stopped spending.

April’s 23% year-over-year decline in new listings of homes for sale looks disturbing at first, but the National Association of Home Builders says it’s actually good for builders.That’s because fewer existing home listings means people who want to move increasingly will need to consider a new home rather than existing one.

Ironically, remodelers also can see hope in the number. If a larger number of people–particularly those with low-rate mortgages–stay where they are, ultimately they’ll get the itch to remodel.

I’m hearing both dealers and remodelers say they have enough booked projects and enough solid leads to keep them busy through the end of the year. If that happens, it’s possible that whatever economic slowdown the rest of the country is having might not occur in LBM. That’s a happy ending that all of us would love to see.

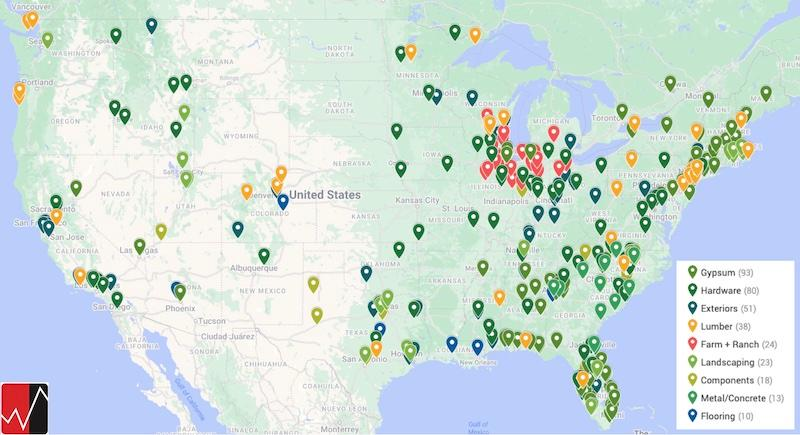

LBM’s Acquisitions, Openings, Closures Activity YTD Varies Sharply by the Dealer’s Specialty

This month’s roundup of LBM deals takes on a different hue–literally–by color-coding all the facilities purchased, newly opened, or slated to close. Looking at the map this way shows how activity involving gypsum operations (orange pins) and hardware stores (black) accounts for half of all the 352 actions that have taken place or have announced opening plans so far this year.

Here’s the breakdown:

- Gypsum: 27.8% of total–93 facilities acquired in deals, 5 greenfield openings

- Hardware: 23.3%–24 acquisitions, 51 openings, 7 closures

- Exteriors: 14.5%–18 acquisitions, 32 openings, 1 closure

- Lumber: 10.8%–18 acquisitions, 16 openings, 4 closures

- Farm + Ranch: 6.8%–24 acquisitions

- Landscaping: 6.5%–21 acquisitions, 2 openings

- Components: 5.0%–7 acquisitions, 11 openings

- Metal: 3.6%–13 acquisitions

- Flooring: 2.7%–0 acquisitions, 10 openings

Acquisitions since mid-April include Bliffert Lumber & Hardware’s absorption of Chase Lumber, a three-store collection in Wisconsin. Meanwhile, TAL Holdings added two Montana stores–Beaverhead Home Center, located in Dillon and Ennis Lumber in Ennis–as well as Harbor Rental & Saw Shop in Friday Harbor, WA.

The biggest deal announced recently involved R.P. Lumber. The Illinois-based dealer sold to Runnings its two dozen R.P. Home & Hardware stores, which focused on the farm and ranch markets. R.P. had purchased these stores in September 2021 from Stock+Field when that company reorganized under Chapter 11 of the federal bankruptcy laws.

Catching up on a previously unreported deal, US LBM sold its five Direct Cabinet Sales stores in February to Express Kitchens. And Hawaii’s HPM Building Supply bought 87ZERO, a Honolulu-based cabinetry supplier.

Exterior and roofing specialists stayed busy with greenfield work. ABC Supply opened new locations in San Bernardino, CA; Pearl, MS; and Granbury, TX. SRS Distribution opened yards in Delavan, WI; Punta Gorda, FL; and Williamsport, MD. An Beacon Building Products opened stores in Longview, TX; and Gulfport, MS.

Non-Competes Can’t Be Imposed Below Management Ranks, NLRB’s Chief Counsel Says

Building material dealers’ non-compete agreements with sales reps and other rank-and-file employees won’t find any support from the federal government. Those non-competes violate the National Labor Relations Act (NRLA), according to a May 30 memo from the National Labor Relations Board’s General Counsel, Jennifer Abruzzo.

Labor law experts noted that this memo doesn’t apply to non-competes between companies and their managers, as the NRLA applies only to non-managerial, non-supervisory positions, the Society for Human Resource Managers reported.

Abruzzo’s memo cited Section 7 of the NRLA, which protecs employees’ right to join or form unions and engage in collective bargaining. Non-compete provisions, she said, “reasonably tend to chill employees in the exercise of Section 7 rights, when the provisions could reasonably be construed by employees to deny them the ability to quit or change jobs by cutting off their access to other employment opportunities that they are qualified for based on their experience, aptitudes, and preferences as to type and location of work.”

There could be some limited cases in which such a non-compete would be valid, she said later in the memo, but “a desire to avoid competition from a former employee is not a legitimate business interest that could support a special circumstances defense.”

Prior Sales Completed by the Principals of Equinova Capital Partners

Coul Installing EV Chargers Generate an Extra Revenue Stream at LBM Dealers?

LBM dealers can speak at length about the pricing power that comes from convenience. Given the steady rise in electric vehicle purchases, combined with a critical need for more charging stations, a question arises: Could building material dealers make money by putting chargers in their parking lots? A recent blog by the charging manufacturer EV Box suggests modest profits are possible.

The blog includes a table with revenue scenarios based on the amount of time a customer would use the charger and how fast that charger would operate. Those scenarios conclude that a company could record monthly gross revenue of $4,928 if its two relatively fast DC chargers were used four times each day for 15 to 30 minutes per session. Those times aren’t much beyond what a DIY customer might spend in a store, particularly for a design consultation.

How much a dealer actually would earn would be based in part on the profit margin sought, the number and type of chargers installed, and how many times daily the chargers would be used. EV Box has created a spreadsheet to help calculate the potential gross revenue.

Naturally, the cost of buying and installing the chargers (which can cost $50,000 for a fast DC version) also matters, but the actual price might not end up that high. The recently passed Inflation Reduction Act contains tax credits for the hardware and installation of chargers, and some states and localities also offer rebates. (Another manufacturer of chargers, Lectron, has created this guide.)

Get 58 Pages of Top-Notch LBM Data

Webb Analytics’ 2023 Construction Supply 150 reveals and analyzes how much America’s key LBM operations changed last year. This 58-page PDF covers 150 LBM dealers, home centers, and hardware chains that in 2022 took in close to $410 billion in the U.S. It also shows how segments of the 150 grew at far different rates they did the previous year. It’s free and available for download here.

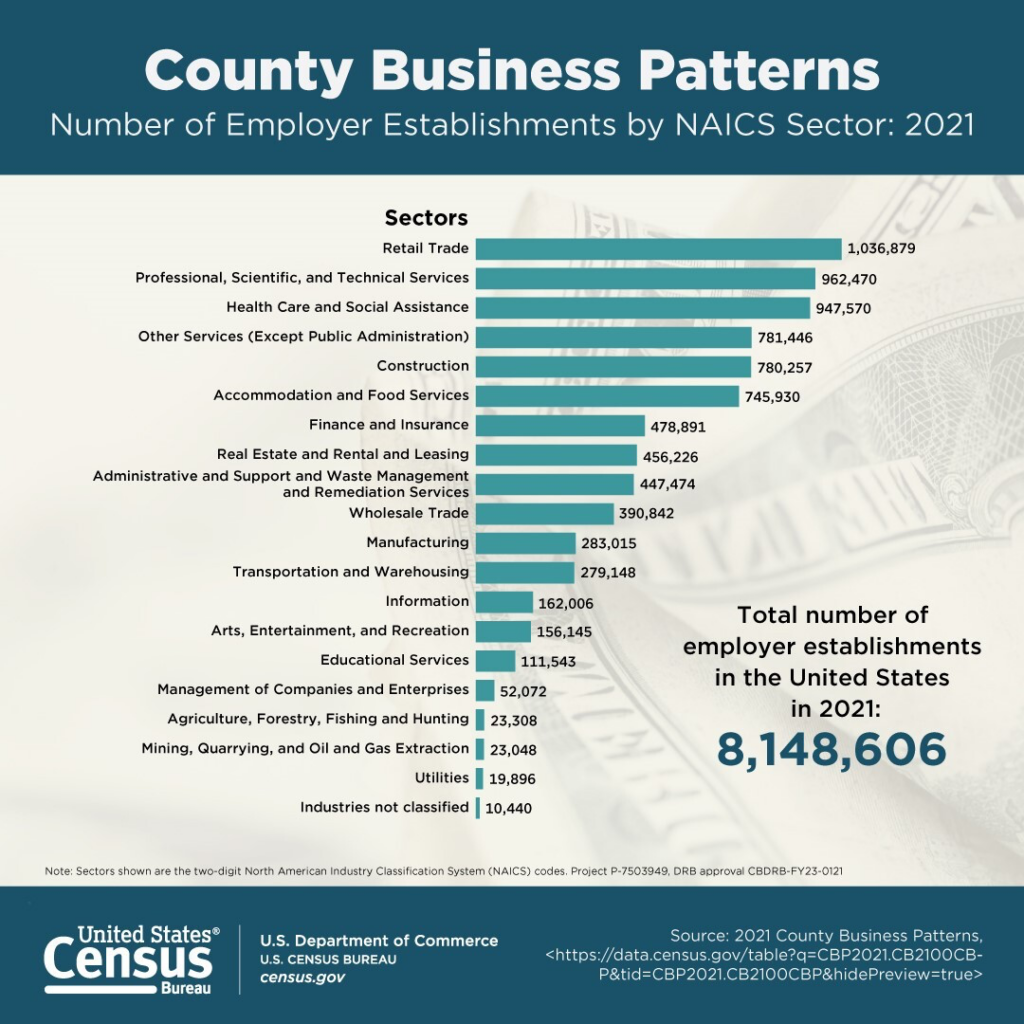

Now Available: County-Level Census Bureau Data on America’s Businesses

Here’s a great way to get a sense of business conditions at an extremely local level. The U.S. Census Bureau has released County Business Patterns data for 2021. This annual series provides economic data by industry for businesses with paid employees. Data include the number of establishments; employment during the week of March 12, 2021; first-quarter payroll; and annual payroll. You can analyze roughly 1,000 NAICS industries at the national, state, metropolitan and micropolitan statistical area, combined statistical area, county, and congressional district geography levels. And it’s all free. Get it here.

Check out EquiNova’s Updated Website

You’re invited to visit our newly updated website, equinovacapital.com, and get a better sense of how we provide M&A advisory services and private equity capital to middle-market companies. The site has sections introducing you to our team, details on the services we provide, and a list of transactions we’ve done.