By Michael Collins, Managing Director, EquiNova

December 2022

‘Tis the season for building material dealers around the country to close their doors and do a comprehensive count of all their stock so they can better understand how their business did in 2022–and what assets they have going into 2023. Taking stock sounds like a good idea for us, too. Here are some of the key developments we saw this year.

Dealmaking Remained Robust. There have been fewer whale-sized acquisitions, but the number of purchases didn’t fall as much as many had expected. (See story below.) The number of buyers and sellers remains robust.

Components Were Hot. You couldn’t help but notice the number of truss, panel, and millwork operations acquired last year, particularly by Builders FirstSource and US LBM. Increasingly, big dealers want to be seen as being able to provide one-stop service for all of their customers’ needs. If you don’t do your own manufacturing, it’s in your interest to maintain close relations with suppliers.

Memories Were Distorted. The housing market has been so hot the past two years that it became standard for builders and buyers to expect ever-rising prices and overwhelming demand. Thus, when sales in some places slowed, reports of that reduced interest bordered on the apocalyptic. Builder sentiment historically outpaces starts when they increase and drops far below actual numbers when starts go down. The latest cries of impending doom again fail to match reality.

GFC Fears Remain. You also probably have heard warnings that we were headed toward the kind of home-building meltdown experienced in the Great Financial Crisis (GFC) of 15 years ago. In fact, most housing numbers have found us returning to historical norms, and banking reforms since GFC have reduced dramatically the problems that helped cause the last crisis.

Lumber Warped Perceptions. The Futures Market proved no friend to dealers this year when reports of declines in lumber features prompted builders to call yards and ask how soon their prices would drop. Dealers spent a lot of time this year explaining to builders that lumber futures weren’t the same as retail lumber prices.

LBM Remains a Great Business. America needs far more new housing than it has been building these past few years. Meanwhile, the average age of homes keeps rising at a time in which we expect homes to perform better than ever–factors that point to a strong repair and remodeling industry. We’ve seen a lot of fads sprout up during this decade of COVID. The desire to live in good homes isn’t one of them.

We’re excited about what’s to come in 2023. As you take stock of where you have gone this year and what you’d like to accomplish in the next, please keep us in mind.

LBM’s Late-2022 Acquisitions Stick to the Year’s Trend Toward Smaller Deals

By Craig Webb, President, Webb Analytics

The construction supply industry typically ends the year with a flurry of acquisitions, but barring a large number of major surprises, we’ll end 2022 with roughly 20% fewer deals that involved 45% fewer facilities as compared to 2021.

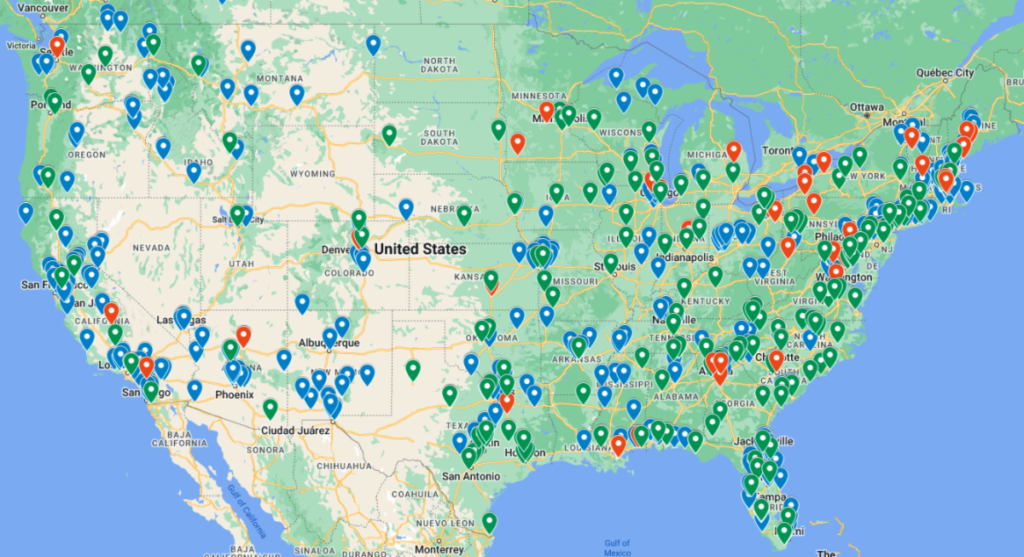

Through today, Webb Analytics’ count shows 134 deals by 60 different buyers that landed them 397 facilities. That works out to roughly three facilities per deal. In contrast, by this point in 2021 there had been 158 deals by 78 buyers that landed a total of 709 locations–an average of 4.5 facilities per deal. The final days of 2021 saw 10 more acquisitions for 14 facilities, cutting the year’s average to 4.3 locations per deal.

Since mid-November, LBM has learned about these purchases:

- Ring’s End Lumber grew its paint business by buying Johnson Paint, whose website lists 10 stores in Massachusetts, New Hampshire, and Maine.

- Kodiak Building Partners continued growing in the Pacific Northwest by absorbing Diamond Home Improvement, which has facilities in Grants Pass and Klamath Falls, OR.

- Nation’s Best Holdings moved into Michigan’s Upper Peninsula by acquiring Forslund Building Supply yards in Caspian, Norway, and Ironwood, MI.

- Bliffert Lumber took over two Milwaukee-based institutions: Milwaukee Cabinetry on Nov. 15, and millwork manufacturer A. Fillinger Inc. on Dec. 12.

- Outdoor Living Supply bought Tahoe Sand and Gravel of South Lake Tahoe, CA.

Meanwhile, Beacon Building Products has been busy adding greenfield locations. Since mid-November, it has opened shop in Rockford, IL; Brownsville, TX; and Georgetown, TX. Among roofing/exterior suppliers, US LBM‘s Universal Supply division opened in Whippany, NJ, while SRS Distribution‘s Superior Distribution moved into Columbia, SC. Another division of SRS, its Heritage Landscape Supply Group, announced that it opened a Stone Center of Texas outlet in Conroe, TX.

ABC Supply–another company that likes to open greenfield sites–announced a new roofing outlet in Havre de Grace, MD, while its L&W Supply siding specialty division moved into Queens, NY.

Elsewhere, Coltrain Hardware opened in Ayden, NC, while Butters’ Ace Hardware opened in Thompson’s Station, TN.