By Michael Collins, Managing Principal, EquiNova

October 2023

One of the most bizarre–and yet most telling–statistics I’ve seen lately comes from the National Retail Federation, which predicts that Americans will spend a record $12.2 billion to celebrate this Halloween. That’s a 15% increase from last year, roughly three times the inflation rate, and it comes at a time in which we’re hearing more and more stories about consumers feeling financially stressed. If money is that tight, why does it seem there are so many more skeletons and goblins on front lawns?

You can find a similar contradiction in the world of LBM mergers and acquisitions. This was supposed to be a year in which the Federal Reserve’s sharp increase of lending rates was supposed to make borrowing so expensive that buyers would walk away from deals. And yet, as of this week, there have been at least 376 construction supply facilities purchased this year, almost exactly the same number as at this point in 2022. Many of the biggest deals have taken place since Labor Day (see story below).

Yes, the 2023 purchasing pace still trails 2021’s by far, but compared with just about any other recent year it’s a solid number. It’s clear there’s still money available to invest in businesses like yours. And, given the dire need for more new housing nationwide as well as more repairs to existing homes, construction supply looks like a strong long-term investment.

There always will be fluctuations in overall valuations, but factors unique to each deal tend to make general trends a bad guide to how a particular transaction will be priced. I’ve found that trying to time the market makes less sense than trying to time a sale or purchase for when it’s best for you. For many of you, now may be that time.

The fourth quarter’s arrival this month featured announcements of a lot of deals that were sealed in the third quarter. If past history holds true, a lot of discussions and final handshakes taking place this quarter will become public just before or just after Jan. 1. Things may be quiet until then, but make no mistake: For all the uncertainties we’re seeing in the economy, there’s a lot of dealmaking going on. If you want to be part of it, we can help.

Kodiak Building Products, US LBM Resume Buying; Kodiak Plans 3 More Deals by January

Returning players and big deals are the LBM M&A market’s themes so far this October. The month saw Kodiak Building Partners make its first purchase in roughly a year and promise more to come. Meanwhile, US LBM achieved arguably the biggest lumberyard buy of 2024 shortly before getting a new co-owner–a likely sign US LBM’s name will appear on more deals.

“There’s still a tremendous amount of opportunity out there,” Kodiak President and CEO Steve Swinney said Oct. 11 at a workshop for building product marketers. Fresh from buying the 13-unit, Pittsburgh-based Don’s Appliance chain this month, Sweeney said Kodiak plans to close three more deals by the end of January. They’ll go on top of the eight deals the $3 billion company has closed over the past 22 months. It has taken in 77 facilities just since 2018 (see map above).

“I think [all the M&A activity] is making the industry more disciplined, which at the end of the day we all want,” Swinney said. The Home Depot and Lowe’s “got big and got disciplined about pricing–they’re not giving things away. That discipline is something our industry needs.”

Swinney said his pre-LBM life includes experiences at Target, which has grown over an era in which hundreds of retail establishments closed or were absorbed. Swinney believes similar consolidation is in construction supply’s future.

US LBM certainly is contributing to that trend. After five years in which it made 35 acquisitions involving 262 facilities (and opened two dozen other locations), the nation’s second-biggest full-service lumberyard went 11 months without buying anything. That streak ended on Oct. 4 with news of its purchase of Florida’s Manning Building Supplies.

Manning is one of the three remaining big lumberyards headquartered in Florida; the others are Tibbetts and RoMac. The deal continues US LBM’s realignment of its Sunshine State properties. As the map above shows, US LBM this year has sold 26 gypsum specialty locations to ABC Supply’s L&W Supply division–roughly half the 51 locations nationwide it has shed in 2023. Now, Manning’s presence in North and Central Florida plus Palm Beach combines with Raymond Building Supply’s footprint from Orlando through the Southwest to give US LBM a stake everywhere statewide except on the Panhandle.

It takes money to buy a company as big as Manning, estimated by one close observer to have $200 million in annual revenue. US LBM may have gotten confidence to make that purchase from the arrival of Platinum Equity as an investor and co-owner of US LBM. Bain Capital Private Equity, which has held controlling interest in US LBM since November 2020, remains as an equal owner.

US LBM’s Manning purchase was one of the biggest for a lumberyard so far this year, but it wasn’t the biggest deal in construction supply since Labor Day. That honor goes to SRS Distribution, which bought Sunniland, a roofing company that also sells lawn chemicals. That’s quite the two-fer for SRS, which has both roofing and landscaping divisions. By the way: 19 of Sunniland’s 21 stores are in Florida, and the other two are just across the border in Georgia.

Meanwhile since Sept. 1, Foundation Building Materials made three purchases, all but one of them gypsum specialists. They were the six-unit A&D Supply, the two-unit HBS Building Supplies, and the single-unit KCI Doors & Hardware.

Elsewhere, 84 Lumber’s newest components plant has opened in Winter Haven, FL. Carter Lumber did the same in Johnsonville, SC. And Henery Hardware bought Hadlock Building Supply on Washington State’s Olympic Peninsula, plus Deer Park (WA) Ace Hardware.

Prior Sales Completed by the Principals of Equinova Capital Partners

Robotic Nail Removers! OSB Made of Grass! Greenbuild Abounded with New Products, Ideas

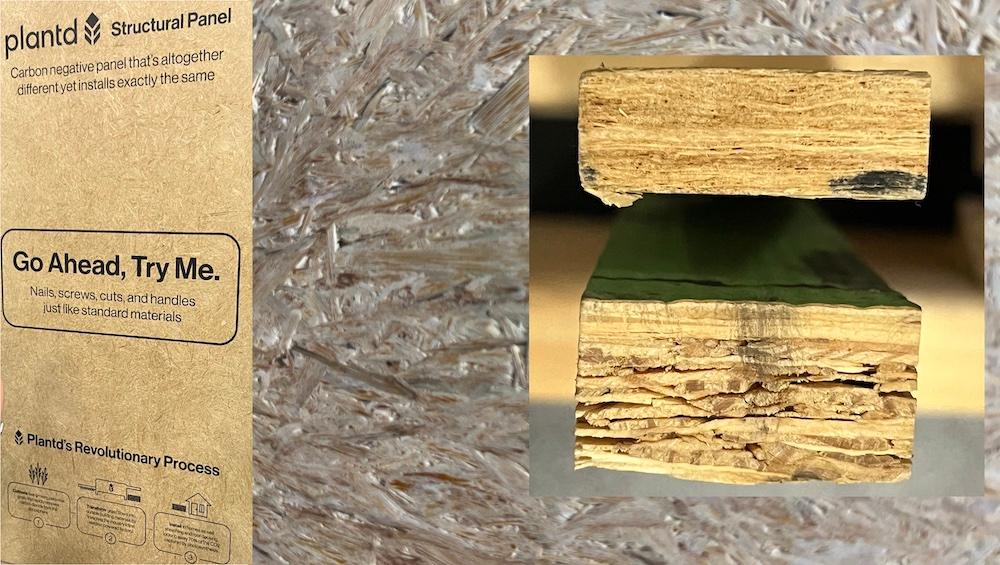

Imagine selling OSB in which the strands are made of grasses rather than wood and the end result is far better at resisting water. That’s the sales pitch from Plantd, a North Carolina company that showed off its boards at the Greenbuild show last month. Plantd is currently producing about 250,000 4×8 panels annually out of a former tobacco company plant, and plans to have a full-scale mill running within a few years. D.R. Horton already is showing interest in the product. Plantd officials say they believe their version of OSB can compete with wood-based lumber, in part because their product’s price will be less volatile than that of traditional OSB. They also touted Plantd’s ability to resist water (see photo above).

Another Greenbuild booth featured Urban Machine, a robotic nail remover nail remover. It’s being tested now at All Bay Mill & Lumber in American Canyon, CA. Urban Machine’s owner expects to have a dozen systems in place next year, then go into full production after that. The goal is to be able to remove nails at a price of about 35 cents per board foot. Lumberyards could offer the device as a service for companies that are deconstructing homes and want to resell the wood to furniture companies, craftsmen, and similar fans of used wood. Urban Machine’s owners believe some lumberyards will want to rent the machine to meet a temporary need, while others might make it a permanent feature, just like hardware stores have key-cutting and knife-sharpening machines.

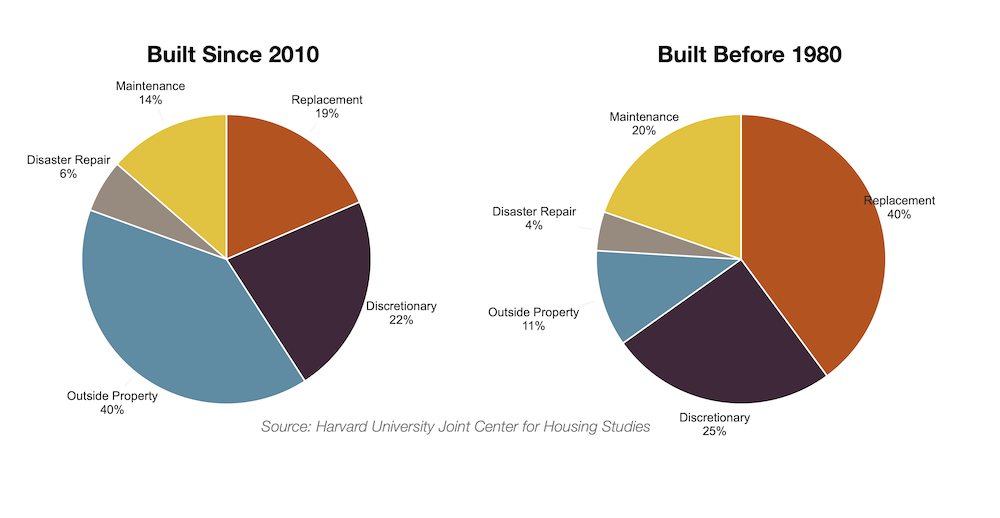

What Types of Remodeling Sell Best Near You? It Depends in Part on How Old the Houses Are

Lumberyard markets can differ by more than just the wealth of the residents or the types of pros served: The age of the homes also can affect what a dealer sells. Carlos Martin, head of the Remodeling Futures Program at Harvard’s Joint Center for Housing Studies, pointed out the potential differences with the pie charts above, which he showed Oct. 12 in Denver at the Building Products Customer Workshop. Using data from the federal government’s 2021 American Housing Survey, it shows that remodeling done on homes built before 1980 is more than twice as likely to include replacement work than remodeling done at homes built since 2010. And improvements to outside property are nearly four times more likely to happen at post-2010 homes than at pre-1980 homes.

That same American Housing Survey also breaks down by race/ethnicity the numbers of pro vs. DIY projects done in 2021. The survey found that nearly half of American Indian, Alaska Native, and Hispanic homeowners did do-it-yourself work. In contrast, only 28% of remodeling done at black- and Asian-owned homes was DIY.

A Reminder: Employ LBM Marketing Tools for Both the Soft and the Hard Sell

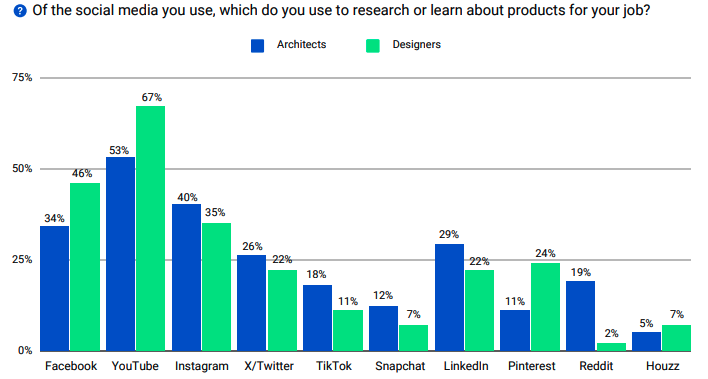

A few eyebrows were raised among the several score attendees at the Building Products Customer Workshop when the event’s organizers showed this slide with results from a survey of architects’ and designers’ favorite social media used for product research. How could Instagram and Facebook be near the top?

Architects and designers are people, too, remarked Beth PopNikolov of Venveo, which put on the workshop along with The Farnsworth Group. That means they’re as likely as anyone else to use Facebook to keep up with friends and Instagram to check out influencers.

“Influencers capture the attention of the 73% of architects on their couch at 9 p.m., drinking wine and scrolling through their Instagram feed,” Venveo and Farnsworth said, no doubt a bit archly, in their commentary next to this information. In other words, construction supply companies should include social media in their marketing efforts because it’s a soft sell, accompanying the robust, hard-sell website and e-mails that get sent during the day.

Check Out EquiNova’s Website

You’re invited to visit our website, equinovacapital.com, and get a better sense of how we provide M&A advisory services and private equity capital to middle-market companies. The site has sections introducing you to our team, details on the services we provide, and a list of transactions we’ve done.