You can see multiple evidence of delays here. Take May’s housing report, which led with the 5.2% decline in single-family housing starts to a seasonally adjusted annual rate (SAAR) of 982,000. But Zonda noted that this was due in part to builders’ decisions to hold up work on 4,800 projects for which they had secured building permits. Given how SAARs are calculated, if they had been started as planned, May’s single-family SAAR starts rate would have been 52,000 higher—and virtually equally with April.

Dealers involved in custom home building say they’re seeing signs that people are taking a longer time between when building plans are approved and the decision to go ahead with construction. Perhaps that stretched-out time period helps explain why the National Association of Home Builders/Wells Fargo Housing Market Index fell to 48 in May. That’s the index’s lowest reading since December 2023.

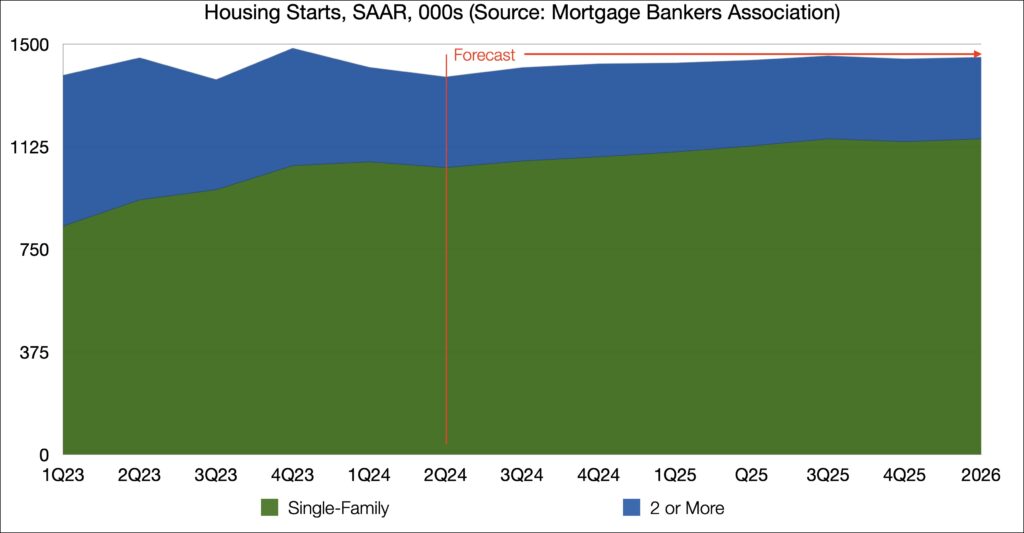

Mike Frantantoni, Chief Economist of the Mortgage Bankers Association, sees a 1% decline in this year’s single-family housing starts from 2023, and then only a 2.5% rise next year from this year. (See chart above.)

Meanwhile, the remodeling industry is seeing signs of balking, too. “Building material prices have risen by 40% since 2019, and homeowners struggle to keep up,” John Burns Research and Consulting said. “Many firms we spoke with this quarter told us that consumers still routinely express sticker shock when pricing comes up. They told us that low-end and middle-market homes are underperforming due to these price sensitivities. Affordability issues help explain the flux of homes coming into the resale market with outdated kitchens and baths—it all ties back to pricing.”