Former Defense Secretary Donald Rumsfeld’s famous description of “Known Unknowns” is particularly pertinent as we head into 2025. The first year of a new presidency traditionally is when major policy changes come out of the White House while Congress approves some of the most important measures of the next four years. What will they be? We don’t know yet, but we can expect some of those moves will affect the housing economy. At the same time, non-political factors like demographics also will have an impact on dealers’ fortunes.

While we don’t know what will happen, we can provide background information to help set the scene. Here are some charts and tales that do that.

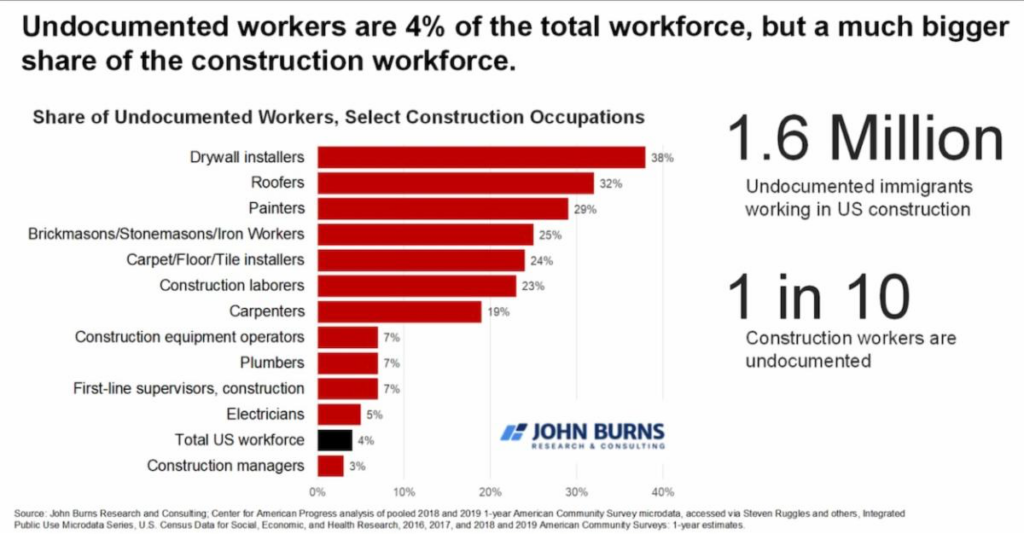

IMMIGRANTS: What’s the potential impact on the construction industry if the Trump Administration follows through on plans to deport undocumented immigrants? It’s well-known that a big percentage of construction workers were born outside the U.S.; some estimates put it at roughly one-third the entire workforce. John Burns Research and Consulting has gone one step further by estimating that 10% of the entire construction workforce is undocumented.

+++

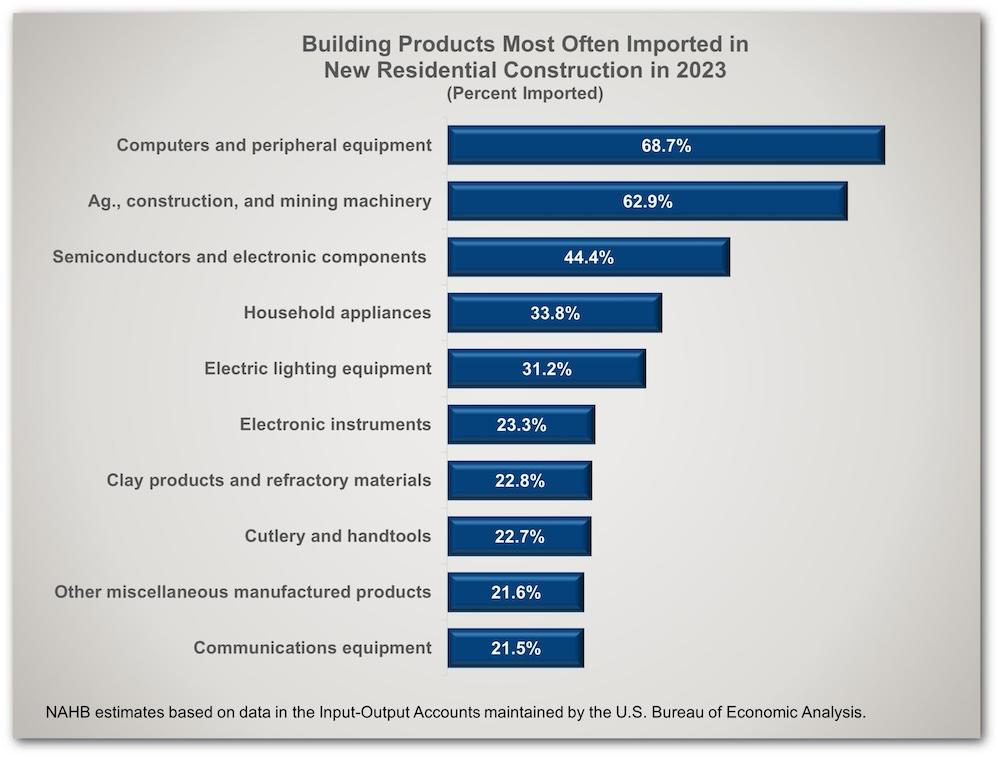

TARIFFS are the second big unknown for construction–and, by extension, dealers–in 2025. LBM dealers have long been familiar with tariff issues, given the longstanding disputes over Canadian lumber. This NAHB chart shows what else goes into a house that generally is imported. The association estimates that China accounts for 27% of all imports used in residential construction when measured by dollar value.

+++

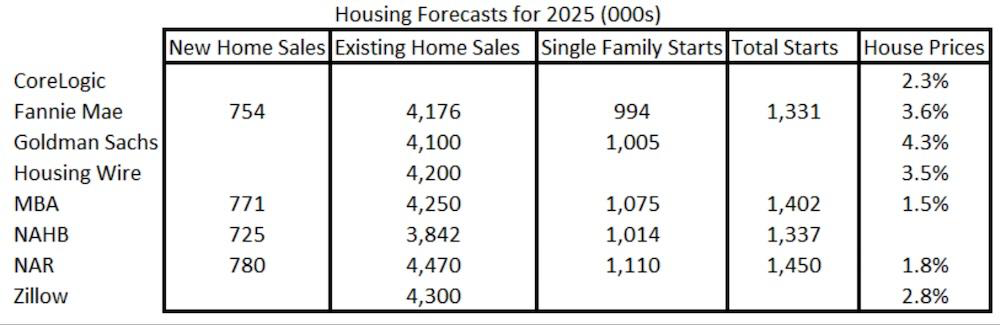

HOUSING FORECASTS will vary by source, but most of the predictions for 2025 call for an increase of a few percentage points from 2024’s output. This compilation comes courtesy of Calculated Risk.

+++

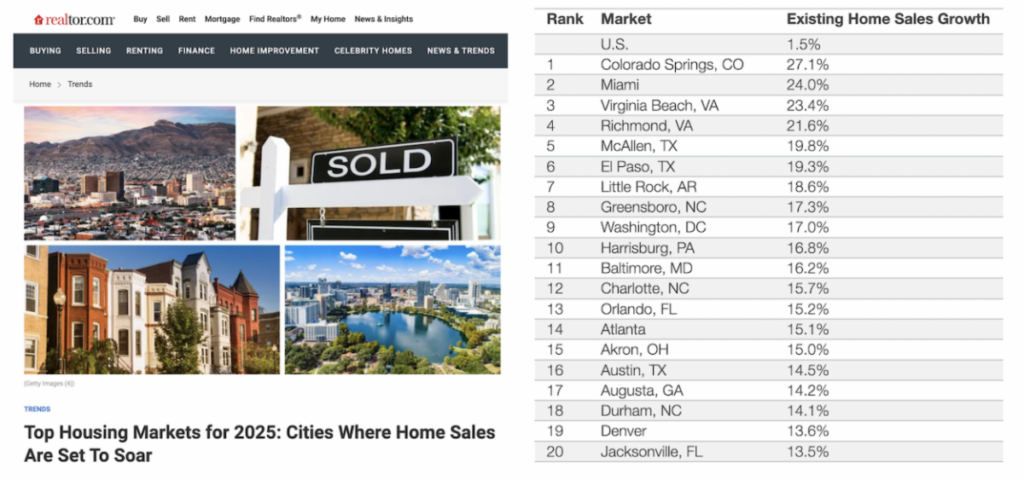

The number of EXISTING HOME SALES will rise nationally by just 1.5% next year, Realtor.com predicts. But every market is different, and, in the case of 20 markets, Realtor.com predicts sales volume increases of 13.5% to 27.1%. Most are in the South.

+++

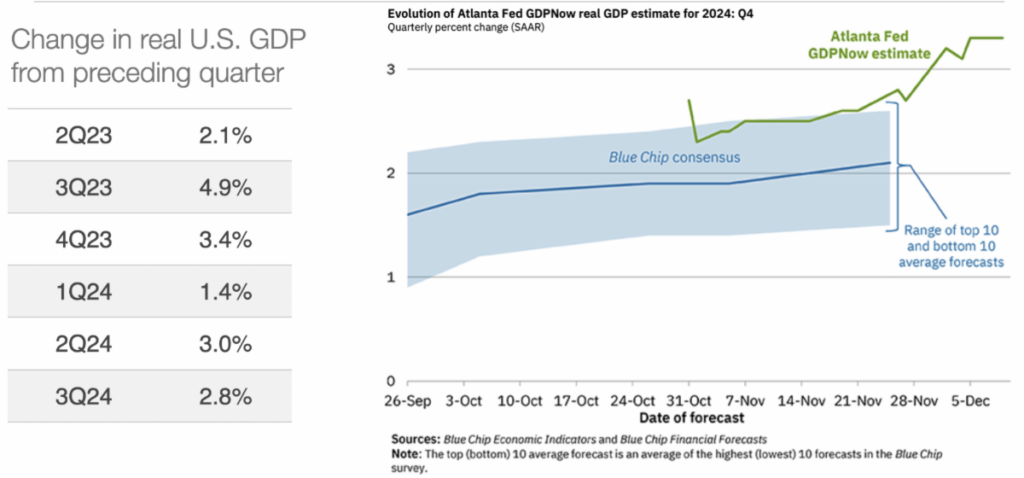

The ECONOMY continues to bubble along–not too fast, but not too slow, either. One of the best ways to track how the U.S. is doing is to watch the Atlanta Fed’s GDPNow report. It takes all the components that go into the gross domestic product as they get reported, and then projects the current quarter’s GDP based on how those components will influence the final result. GDPNow isn’t a perfect predictor, but it has consistently proven to be more accurate than what blue-chip economists have forecast.

+++

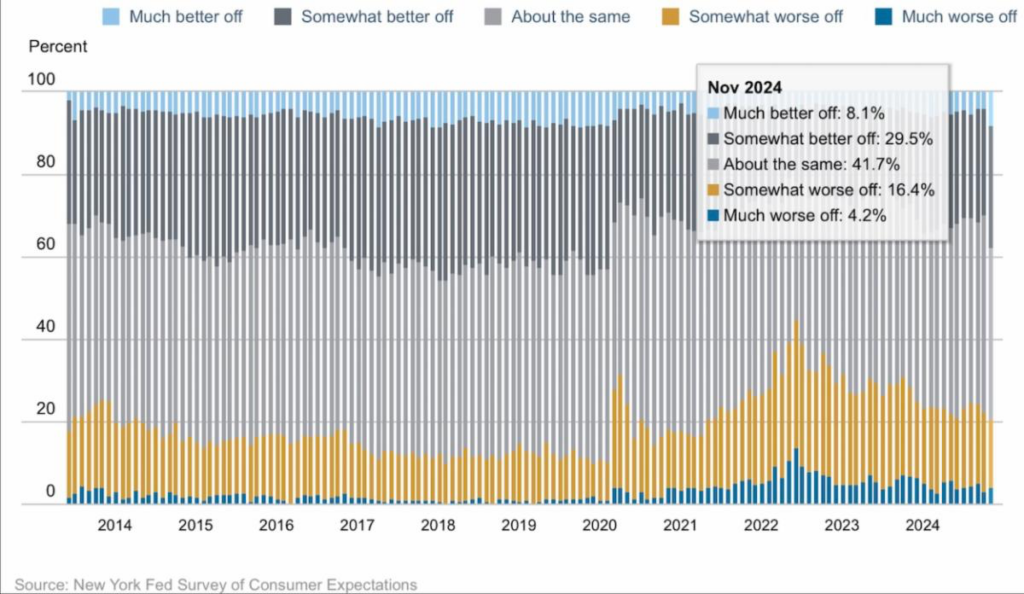

CONSUMER ATTITUDES played a huge role in the presidential election, with inflation and buying power being top factors in voting decisions. The New York Fed tracks economic opinion with a monthly survey in which it asks people to predict their financial situation one year from now. Back in mid-2022, when inflation was hottest, only 21% of respondents expected to be somewhat or much better off, while nearly 45% expected to be in worse shape. But as of November, nearly 38% are optimistic and only 21% see worse conditions ahead.

+++

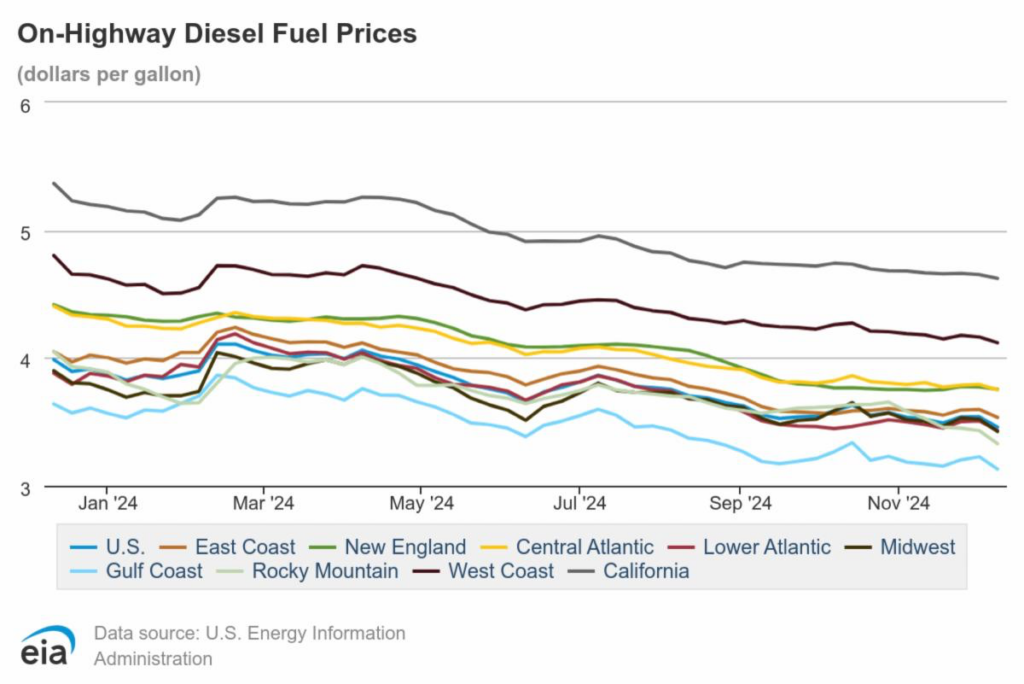

FUEL PRICES are one area giving people reason to feel good. For instance, diesel prices are down 13.3% from a year ago, the U.S. Energy Information Administration reports.

+++

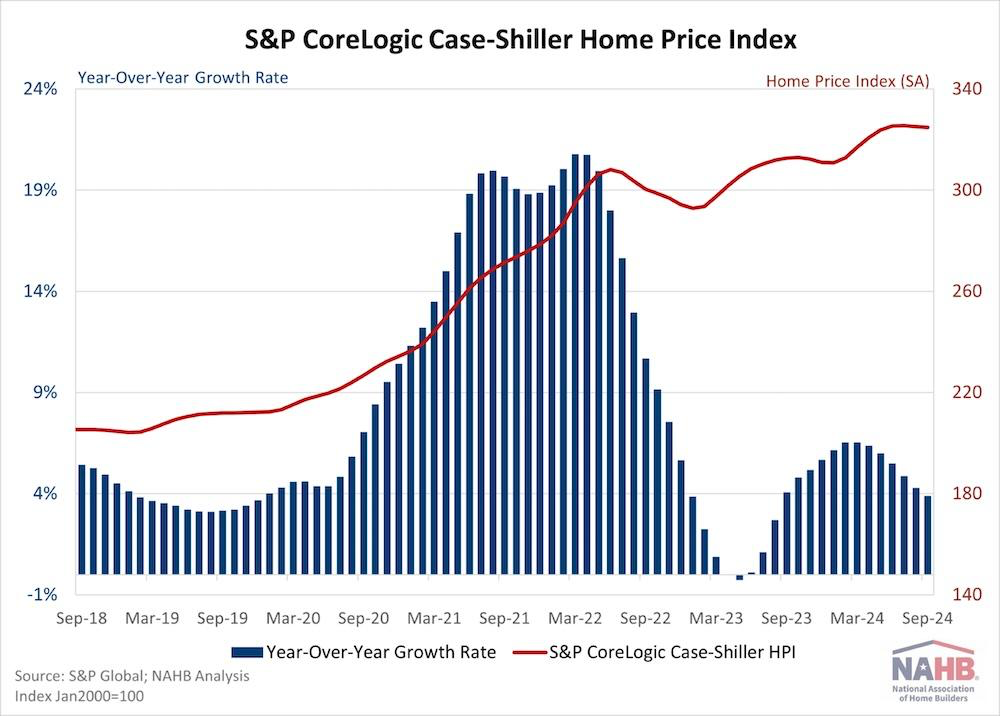

HOME PRICES are a different story. While year-over-year price increases have gone down for several months, the cumulative effect has been striking, as this NAHB chart of the Case-Shiller Home Price Index shows.

+++

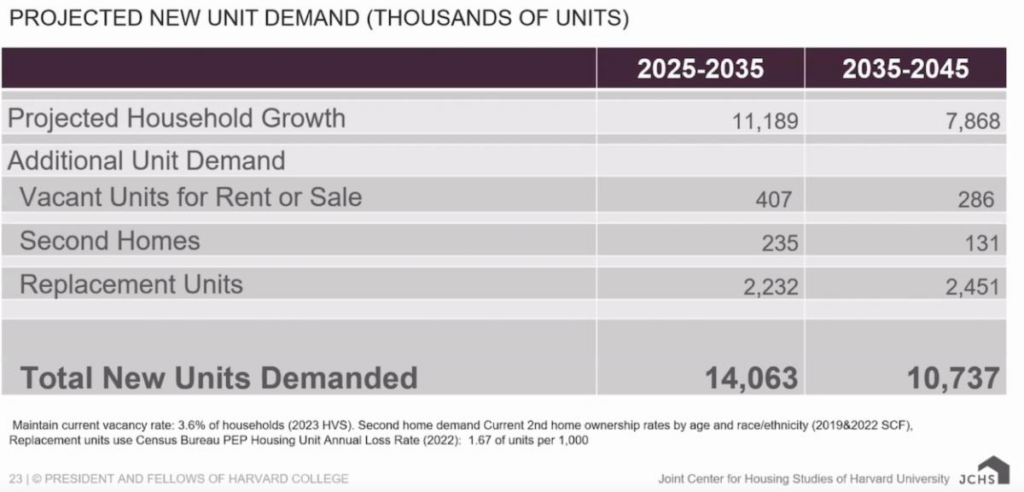

If there’s any reason for long-term optimism in LBM, it’s that the HOUSING SHORTAGEshows no signs of abating. In fact, a report by Harvard University’s Joint Center for Housing Studies estimates we’ll need to build 1.4 million new homes each year for the next 10 years just to keep up with demand. And that 1.4 million doesn’t cut into the current shortfall of several million homes. Clearly, America is going to need for years to come what building material dealers provide every day.