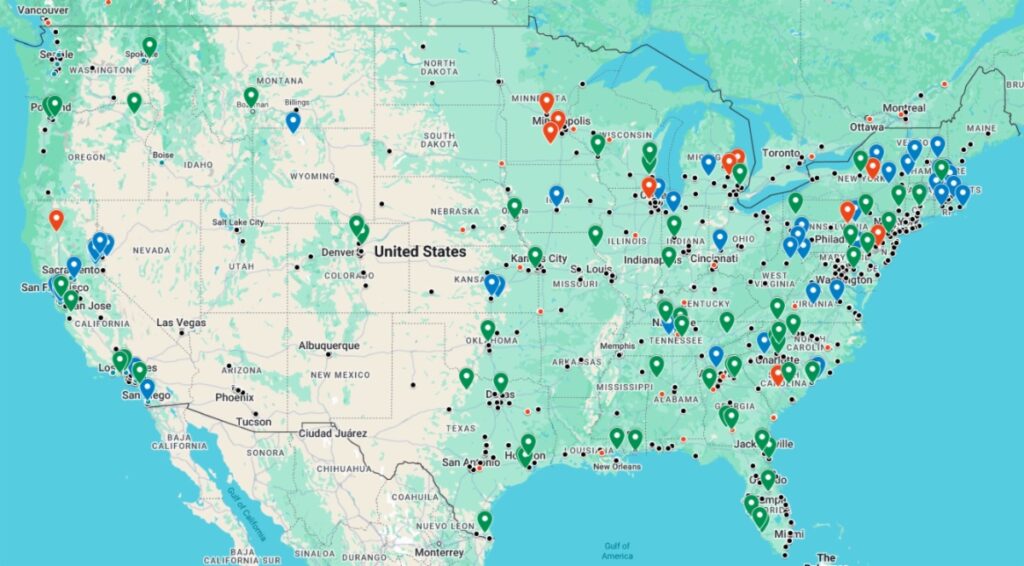

LBM deals (blue pins), greenfield openings that have happened or are planned (green) and closures (red) YTD. Beacon sites to be acquired by QXO are marked with black dots. Not shown: A planned store opening in Alaska. Source: Webb Analytics

By Craig Webb, President, Webb Analytics

As with last year’s Home Depot-SRS Distribution deal, one acquisition predominates on LBM’s 2025 deals map: QXO’s takeover of Beacon. But once you exclude those two purchases, it’s clear this year has been fairly quiet. Webb Analytics’ count shows just 28 deals by 19 buyers for 54 locations. That compares with 51 acquisitions in 2024 involving 31 buyers for 103 locations.

On the other hand, 2025 activity has featured something we haven’t seen much lately: Green startups..

There have been three. Kennon Lumber sprang to life recently in the eastern Oregon town of Elgin. Founder Tyler Kennon, a combination handyman/contractor/farmer/rancher, is sourcing cedar, pine, and fir wood products from an area native who runs a lumber mill in northern California.

Then there’s Ponderosa Building Supply, which Kodiak Building Partners set up in Hauser, ID, just east of Spokane, WA. Most of the Kodiak-owned lumberyards are west of the Cascades, so the creation of a brand-new, separately named lumberyard could signal it plans to grow in the Rockies. Kodiak also made a purchase recently, acquiring New River Building Supply of Boone and Banner Elk, NC.

And finally there’s Revol Building Solutions, a components plant that has started business in Wanatah, IN, southeast of Chicago. Co-founder Joshua Ratcliff is a former executive at Ambassador Supply. That company had purchased the Wanatah property from Continental Carpentry in 2022, and now Ratcliff and co-founder Stinson Dean are starting up on their own.

As for acquisitiions, there have been two significant ones since mid-March: Builders FirstSource’s purchase of Truckee-Tahoe Lumber, whose seven locations serve northern Nevada and California’s upper Lake Tahoe region; and SRS Distribution’s purchase of Stateline Irrigation Supply, a landscaping company with nine locations in Massachusetts, New Hampshire, Rhode Island, and Connecticut.

In other M&A activity:

* R.P. Lumber bought Aldrich Home Center of Powell, WY. It’s R.P.’s third branch in the state. R.P. also opened a new store in Quincy, IL.

* Schockman Lumber Group, a holdng company for several smaller dealers in the Midwest, purchased F.A. Requarth of Dayton, OH. That dealer is famous for having sold lumber to the Wright Brothers.

* ABC Supply purchased Roofing & Supplies Inc. of Richmond, VA.

* Westlake Ace Hardware took over Edgebrook Ace Hardware of Chicago.

* Costello’s Ace Hardware took over Aldrich Home Center of Appomattox, VA.