By Michael Collins, Managing Partner, EquiNova

August 2023

A friend of mine enjoys listening to a radio station in Mendocino County, CA, where the playlist leans heavily toward The Grateful Dead and alternative versions of ’60s and ’70s hits. He also likes the morning disc jockey, who makes a point of saying he’s a real person, not some form of artificial intelligence. There’s community news every half hour and homemade commercials voiced by local merchants–in short, everything that makes local radio so charming.

What’s not local is my friend. He lives on the East Coast and listens to KOZT-FM over the Internet. Lots of other fans listen in from around the world, judging by the hometowns of people who win the station’s daily music trivia contest. Clearly, this station is marrying traditional values with newer technology to be more than just a little broadcaster limited to the Northern California coast.

Time was, the most sophisticated technology seen at a construction supply dealer was the smartphones on employees’ belts. Thanks in good part to COVID, it’s common now to see dealers offer online billing presentment, bill payment, and initial ordering. Co-ops such as Do it Best and ACE Hardware as well as software firms like Epicor, ECI, and DMSi have helped thousands of dealers tip their toes into e-commerce.

But we can’t stop there. We need to wade deeper.

The first reason why is potential. The Census Bureau estimates that 15.1% of all retail sales in this year’s first quarter took place online, led in part by stores with physical locations such as Target (17.5% of all sales), Macy’s (30%) and Nordstrom (38%). But online operations at big boxes such as The Home Depot and Lowe’s trail at 14.2% and 10% of all sales, respectively. Hardware stores and small, retail-only dealers invariably are much lower.

Bigger construction supply dealers might score better than their peers if they also get orders via systems such as EDI (Electronic Data Interchange). By adding that system to its online store sales, Beacon figures 13.5% of its 2021 sales came digitally. Beacon wants to grow that share to 25% by 2025 and ultimately hit 50%.

Other dealers might not be as ambitious, but it’s worth their time to ask themselves what digital growth could do for both their in-store and purely online sales. The Home Depot estimates that half of its online orders are fulfilled in-store. That has to lead to extra sales once the customer arrives at the store. Dealers’ launch of BOPIS–buy online, pick up in store–as well as lockers should provide the same opportunity, provided they promote the service.

Online sales might also come from customers who have issues expressing themselves in English. One hardware store owner told my East Coast friend that he had noticed online sales by neighbors with Korean family names who he couldn’t recall visiting the store. It could be those people preferred a computer interface.

Then there are the faraway sales. Dealers who pride themselves on stocking rare species of wood have been doing this for years, but wood isn’t the only possibility. One small dealer in Missouri has made a name for itself across several states through the size and depth of its Milwaukee tool assortment.

Dealers deserve credit for all they’ve achieved technologically, making a decade’s worth of advances in the past two years. Now, with artificial intelligence opening up new opportunities to advance and a slowdown in business that’s finally providing time to think about the future, construction supply companies are in a position to go even further.

One interesting sidelight of my friend’s favorite radio station is that it also plays new music from all those old record artists. Paul Simon, Peter Gabriel, and Robert Plant are still creating, and the Dead have never stopped improvising. Dealers can do the same.

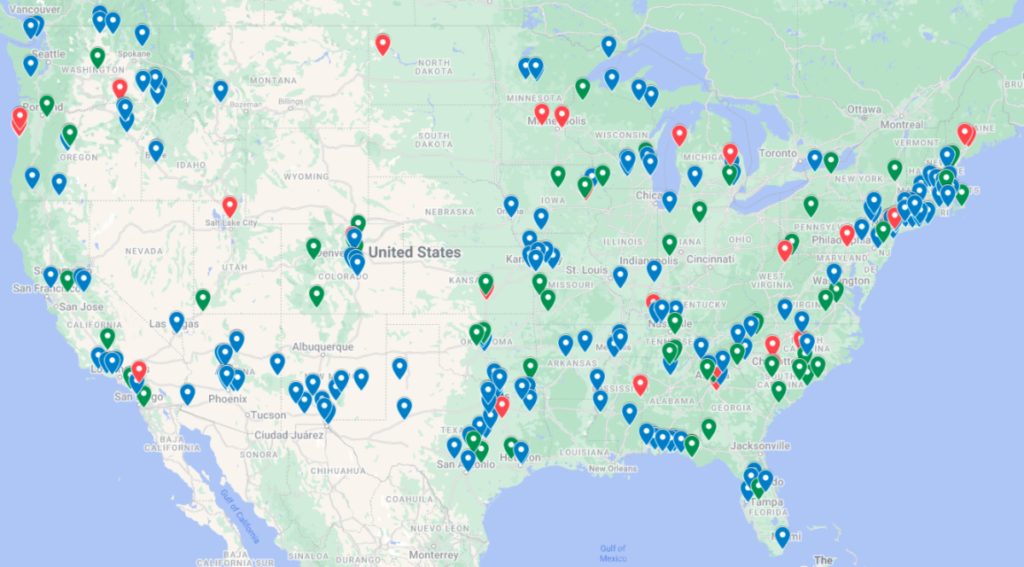

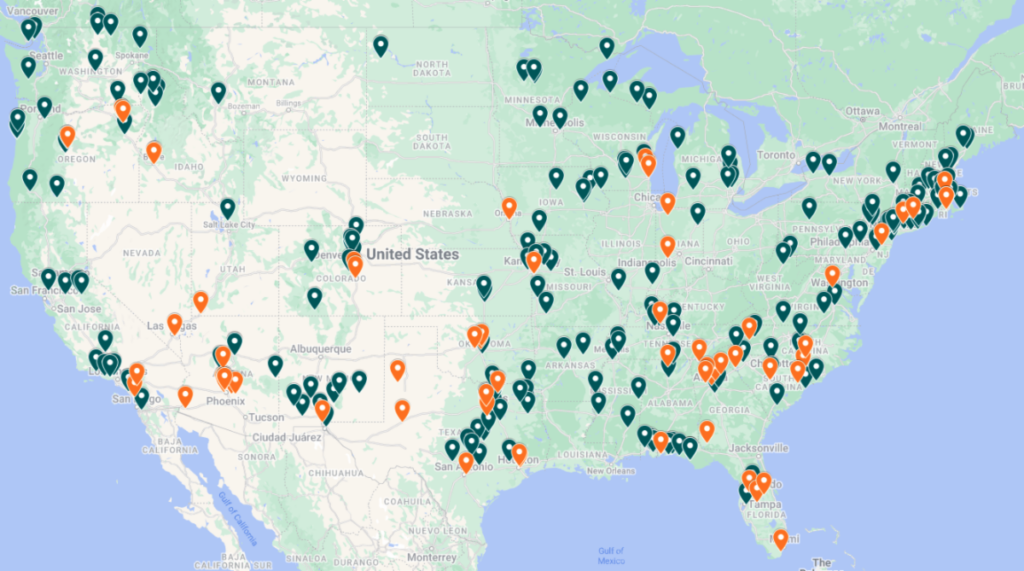

We’ve Had Nearly 300 Lumberyard, Truss and Millwork Deals, Opens and Closes Since Jan. ’22

These two maps show where and what’s been happening with lumberyard, millwork, and truss/components operations nationwide since the start of 2022. The map at top breaks down the 295 facilities based on the 196 locations that were acquired (blue pins), the 67 that had greenfield openings (green pins), and the 32 that have been closed (red pins).

The lower map divides those same 295 facilities based on the 226 that primarily are lumberyards and the 69 that were truss/component or millwork operations. Missing from both are Alaska and Hawaii’s combined three acquisitions, one opening and one closure.

Builders FirstSource contributed four of the most recent pins to hit the maps. BFS, which has plans to spend $500 million on acquisitions annually, increased its investment in value-added product manufacturers by acquiring JB Millworks of Ringgold, GA, and Builders Millwork of Anchorage, AK., It also grew in Detroit by buying Church’s Lumber Yards of Lapeer and Auburn Hills, MI.

Many of the closures were old sites shuttered when new plants opened nearby. That happened in August in Capistrano Beach, CA, where Ganahl Lumber closed a longtime branch simultaneously with its opening of a big new store in San Juan Capistrano. Likewise, BFS closed yards in Lincoln City and Newport, OR, because it opened a new facility in South Beach, OR.

Among other recent lumber/components actions:

- R.P. Lumber purchased Wright Building Center’s store in Sparta, IL. Wright will continue to operate its store in Murphysboro, IL.

- West Coast Lumber took in its first truss operation by buying Stone Truss of Oceanside, CA. WCL was founded by Building Industry Partners.

- Nation’s Best Holdings kept growing in Texas by acquiring Cain Hardware of Carthage.

- In the Memphis area, Maximus Building Supply took over Brighton (TN) Lumber.

- The Detering Company opened a lumber specialty facility in Houston.

- 84 Lumber’s new components plan will open in Winter Haven, FL, on Sept. 13

- Moore Lumber opened a new store in Castle Rock, CO.

- A brand-new firm called The Truss Company and Building Supply came to life in Redmond, OR.

Over all parts of construction supply, through Aug. 10 we have had 260 facilities acquired vs. 273 at this point last year. The opening count is higher, with 141 greenfields year-to-date against 128 by this point in 2022. We already know of another 27 stores scheduled to open before this year closes.

Prior Sales Completed by the Principals of Equinova Capital Partners

What a Drywall Dealer’s Trade Secrets Case Also Tells Us About Non-Competes and Culture

A recent North Carolina court ruling involving Foundation Building Materials (FBM) and a renegade branch focused on what constitutes a trade secret. But the case also has lessons on two other issues that need to be considered when one dealer acquires another.

The case concerns a former Beacon branch in Charlotte, NC, that FBM took over in February 2021 when it acquired all 81 of Beacon’s interior products specialty branches. The Charlotte branch was managed by Jeremy Chavis. Two years later, Chavis and, ultimately, 17 staffers of the 20-employee FBM branch quit to start the Charlotte branch of a New York-based drywall dealer, Conking & Calabrese. They began competing directly with FBM and started winning customers that they had been serving while at FBM. FBM sued, claiming Chavis and others stole trade secrets.

The court eventually ruled against FBM on most counts. You can read the decision here. When you do, take note that FBM didn’t have Chavis or any other Charlotte branch employee sign a non-compete or non-solicitation agreement. Thus, FBM couldn’t use those documents as part of its case. Requiring signatures on such pacts probably would have kept this problem from ever occurring. Undoubtedly, asking managers at 81 branches to sign non-competes could cause paperwork headaches or keep a deal from closing. However, it also might give those managers a sense of how important a contribution the new owner felt those people brought to the company.

The renegade Charlotte branch also is an example of what can happen if an entire group of employees moves to a new company at one time and continues to work together under the same leaders–and in this case, in the same location. Examples abound in LBM of how such teams will take their old company’s cultural norms with them and will keep using those standards unless explicit efforts are made to inculcate the team into the new company’s way of doing things. The fact that all but a few of the Charlotte branch’s employees chose to leave suggests they were more loyal to Chavis and their teammates than to FBM.

The moral here is that even the smoothest acquisition can be followed by a tough transition, particularly for employees outside the C-suite. Investors often talk about how they look for a cultural fit when they assess a target company. But just because most parts of an acquired company will embrace a new owner doesn’t mean every part will, particularly if that group’s leader isn’t won over.

Reminder: Internal Theft Doesn’t Go on Vacation

An employee at a construction supply company in New Jersey has been charged with stealing nearly $270,000 from his employer over little more than a year. According to an announcement from the Monmouth County prosecutor, Mark Cocciardi Jr. is accused of using sales receipts to process fictitious returns of building materials that customers had previously purchased. “He then issued himself credit for the materials on his personal credit cards–just short of $268,000 in all,” the announcement said. Cocciardi was charged with second-degree Theft by Deception. The company involved wasn’t identified.

Get 58 Pages of Top-Notch LBM Data

Webb Analytics’ 2023 Construction Supply 150 reveals and analyzes how much America’s key LBM operations changed last year. This 58-page PDF covers 150 LBM dealers, home centers, and hardware chains that in 2022 took in close to $410 billion in the U.S. It also shows how segments of the 150 grew at far different rates they did the previous year. It’s free and available for download here.

Check Out Equinova’s Website

You’re invited to visit our website, equinovacapital.com, and get a better sense of how we provide M&A advisory services and private equity capital to middle-market companies. The site has sections introducing you to our team, details on the services we provide, and a list of transactions we’ve done.