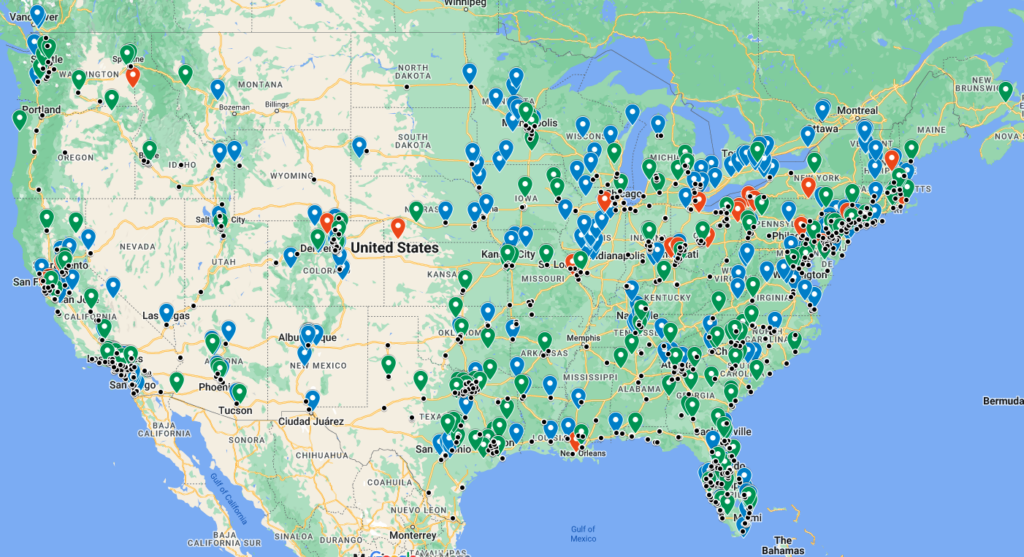

A total of 118 purchases involving 58 buyers have caused facilities in 1,043 locations to change hands so far this year, the latest count from Webb Analytics shows. That compares with 100 deals by 81 buyers that took over 320 facilities by this point in 2023.

There also have been 178 facility openings (either in fact or planned for this year), roughly on pace with the 164 actual openings through mid-September 2023. Only 33 closures have been announced vs. 42 that we knew for sure about by this time a year ago, but closures often take longer to be discovered.

Five states figure in 41% of the 1,254 total actions year-to-date in 2024. California is the most active state, with 159 purchases, openings, and closures. Florida comes next at 131, followed by Texas (111), Pennsylvania (58), and North Carolina (56).

The biggest deal in recent weeks was Foundation Building Materials’ purchase of Unified Door & Hardware, a mostly mid-Atlantic operation with 15 locations. Also recently:

- GMS bought R.S. Elliott Specialty Supply, a gypsum operation with five stores in Florida.

- US LBM took over Gregory Door & Window of Breckenridge, CO, as well as Nix Door & Window of Fort Worth, TX.

- Beacon Building Products acquired Chicago Metal Supply & Fabrication, based in the Windy City.

- Kodiak Building Partners bought the two-unit San Antonio Masonry and Steel.

- Crosslin Building Supply took over Lee’s Quality Building Materials of Springfield, TN.

- Parr Lumber acquired Rochester (WA) True Value Hardware & Lumber.

- The Aubuchon Co. picked up four more hardware stores in Pennsylania when it bought CBM Hardware.

- Structural Building Solutions acquired Wisacky, SC-based East Coast Components.

New store openings were announced by Carter Lumber in Columbia, SC; RWC Building Products in Sacramento, CA; L&W Supply (a division of ABC Supply) in Cedar Rapids, IA; Ivey’s Building Materials in Shreveport, LA; and Texas Building Supply (a division of US LBM) in Liberty Hill, TX.